Algomojo offers Free API + Free Trading Platform to algomojo users to Place, Modify, Cancel Orders. Currently, Algomojo API is free for the users who are opening a trading account with Algomojo Partner Brokers. Free API platform + Free Algo Trading platform is offered with no upfront fees, no minimum turnover, no special terms and conditions, no clauses, no strings attached.

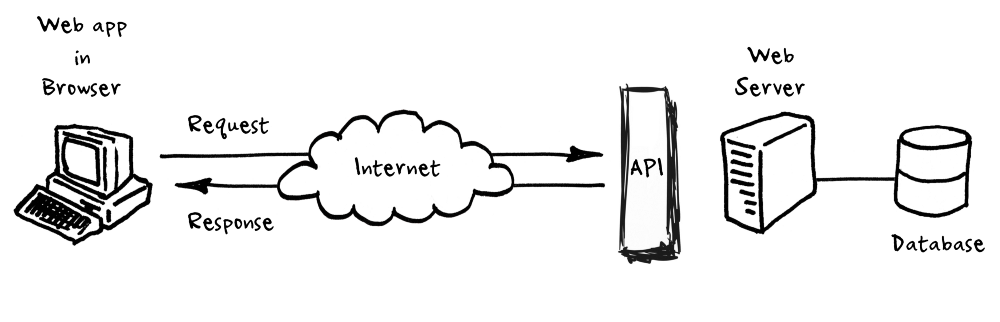

What exactly is an API?

API stands for Application Programming Interface (API). Algomojo offers http-rest API and it basically a communication layer to Authenticate/transmit/receive information from your broker server and can be used to submit orders/cancel orders/modify orders to the broker’s server programmatically. You can use the API as a communicating layer between your trading software (Amibroker, Metatrader, Ninjatrader, Tradingview, Excel… etc

You can refer the Algomojo Documentation here for more detailed API functions & instructions.

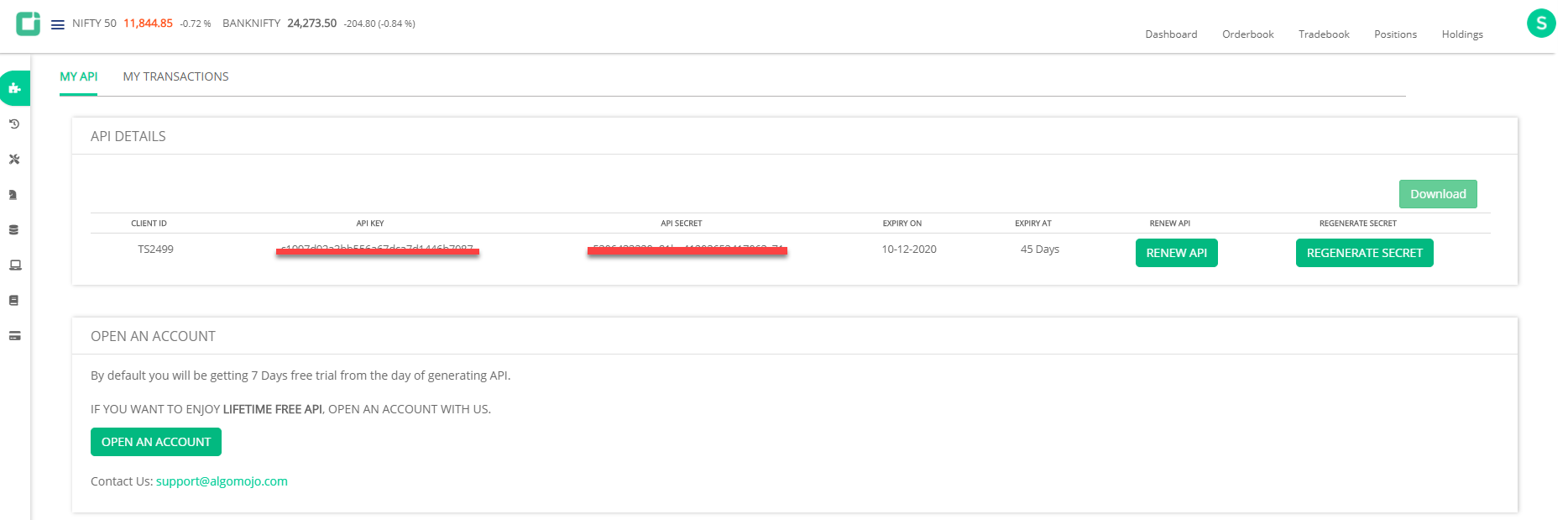

So use Algomojo API it requires you to register for an API key & API secret key to communicate with your broker server. In order to get the API key you can log into Algomojo with your 2FA trading account login credentials and go to My API section and generate your API key and API secret key.

What is the Overall Cost Involved in Algomojo?

Traders opening a trading account via Algomojo with our partner brokers will be enjoying Free API + Free Platform Fee under both Discount Broking (Rs20 per order) / Percentage Based Broking Model (0.01%) or whatever the broking plan our partner broker offers).

Here are the List of Cost Involved while deploying Algos

1)Trading API Cost: Free (For Algomojo Account Opening Clients)

2)Algomojo Platform Fee: Free (For Algomojo Account Opening Clients)

3)Datafeed Cost: Optional

4)Data API Cost: Optional

4)Strategy Cost: Traders are recommended to come up with their own trading strategies. If in case looking for sample codes then free strategies can be downloaded from the Algomojo Library

5)Supportive Platforms: Amibroker, Metatrader, Tradingview, Excel, C#, Python, Any Platforms that Supports Rest-HTTP APIs

6)Virtual Private Servers: Optional

7)Broking Charges: All F&O and equity trades would continue to be charged at Rs 20 or 0.01% according to your broking plan with our partner Broker and there are no restrictions on choosing on your broking plan with partner broker. Irrespective of the broking plan Algomojo client will enjoy Unlimited & Lifetime free access to Trading API and Algomojo Platform.

8)End to End Integration/Chat Support: Free.

Algomojo Provides data products for NSE Cash, NSE Futures, MCX Futures & NSE Currencies, and is currently tied up with Authorized data vendors GlobalDatafeeds & Truedata to offer data & data API products to its customers.

What is the Pricing for Non-Algomojo Clients?

Currently, Non-Algomojo clients who want to onboard Algomojo Platform with their existing broking account but not mapped under Algomojo will avail free Algomojo API access however there will be a platform fee of Rs 999/ month or Rs5999/year (revised Pricing) will be charged.

7 Days of Free Trial is available for Non-Algomojo clients to test drive before paying Algomojo Platform Subscription fee.

Trading Terminal Access is totally free for Non-Algomojo Clients to send orders manually/retrieving the orderbook/tradebook/open positions/watchlists from Algomojo to their broker account.

What are the Type of Orders Supported at Algomojo?

All types of orders are supported at Algomojo (Market Order, Limit Order, SL-Limit Order SL-MKT order, Bracket Order, Cover Order, AMO orders).

Algomojo also supports rule based ATM, ITM, OTM Option Orders

Algomojo supports Order Placement, Order Modification, Order Execution, and Retrieval of Orderbook, Trade Book, Order History & Open Positions via API.

Is the Web-Based Bridge Slower than the Exe Based Bridge?

Nope. Both use Rest API as a communication layer to transmit or receive information from the broker server. The latency of execution mostly depends upon the client’s internet speed and Brokers’ server responsiveness. In another article will look into this information in detail. However, it is a myth that Web-Based Bridge is slower compared to Exe based Bridge. In-fact web-based bridge has more ease of use and no up-gradation/installation/maintenance is required from the client’s side.

If in case you are having any queries always you can send a mail to support@algomojo.com

Is it possible to send orders from tradingview platform? does it supports free tradingview plan?

Yes, Algomojo supports tradingview webhook feature. however one needs to be a tradingview pro user. Webhook feature is not available in free plan.

Minimum of Tradingview Pro plan is required to send automated orders from Tradingview to Algomojo platform.

Can I send orders simultaneously from both tradingview and amibroker? How many strategies I can run?

Yes, you can send orders simultaneously from both tradingview and amibroker. There are no limitations in the number of trading strategies that you can run.

What are the requirements a algo trader need to know before kickstarting with algomojo platform. Im a begineer in trading but like to do algotrading. Need you guidance.

Here are the following inputs an algotrader needs to know.

1)Knowing better about your trading software from which you are generating signal. Knowledge on backtesting your signals is very important and better knowledge about the nature of the trading system and risk controlling mechanism in your trading system.

2)Better datafeed connecitivty (authentic data vendors)

3)Better Trading Infrastructure (Good Internet connection and Good Power Backup)

Iam a C# developer in gurgoan. Can I use algomojo API to deploy my own trading system in the cloud?

Yes you can build your own customized trading solution in c# and deploy and definitely Algomojo API simply your effort in building a customized trading solution

If in case you have more queries send your queries to support@algomojo.com

While sending orders via Amibroker/Tradingview how to Backcheck whether orders are entered properly or not?

There are two ways one can do the check their logs

1)Using Trace Function or External Debugger to record the orders that are sent via Amibroker

2)Using Algomojo Order Log Feature which captures only Automated Orders.

If you are using Tradingview then Alert log feature captures the all the alerts that sent via Tradingview Webhook Alerts

When we can expect paper trading in algomojo. which is mostly required to test drive the trading straegy before taking live. I guess algomojo still missing this feature.

Yeh Joshi our development team is already working on that. It is already in our next phase release.

How to send order from python using Algomojo API. Do you have any tutorials for the same?

Thanks for asking yes we are also coming up with python based algo trading execution modules. stay tuned!

Pingback: How to use Postman to Send Orders to Your Trading Account – Algomojo | Blog

Pingback: How to use Postman to Send Orders to Your Trading Account – Marketcalls

Pingback: How to use Postman to Send Orders to Your Trading Account – Marketcalls | BullseyeFX

I want to use Algomojo with Upstox trading platform. Please let me know the charges.

For Algomojo Clients Who are opening Upstox Account Via Algomojo – Platform Fee is Free Forever.

For existing Upstox Account users there will be a platform fee will be there.

-Monthly Pricing starts at Rs2000/-

-Annual Pricing at 12000/-

Hi Rajandran,

We are looking forward to this paper trading feature.

In the next phase of the Algomojo Release already paper trading feature is planned.

Since you are providing REST API , so that we can call from python application to place order. How web based API bridge comes into picture here and why it is required?

Algomojo is used for Web Authentication, Trade monitoring and also Algomojo Web will be acting like a web terminal.