Introduction

The Short Butterfly Spread is an advanced options trading strategy designed for high volatility markets. Unlike the Long Butterfly Spread, which benefits from low volatility, the Short Butterfly is ideal for traders expecting a significant move in either direction. It offers limited risk while allowing for potentially high rewards if the price moves far from the center strike.

In this blog, we will explore the Short Butterfly Spread, its construction, advantages, risks, and how to implement it using Algomojo.

What is a Short Butterfly Spread?

A Short Butterfly Spread is an options strategy that profits from large price movements in either direction. It involves selling a bull call spread and a bear call spread, making it the inverse of a Long Butterfly.

Structure of a Short Butterfly Spread

This strategy consists of three strike prices and four options contracts:

- Sell 1 lower strike call option (ITM)

- Buy 2 at-the-money call options (ATM)

- Sell 1 higher strike call option (OTM)

This creates a position where you profit if the underlying moves significantly above or below the middle strike price.

Example of a Short Butterfly Spread

Assume Stock XYZ is trading at ₹100, and you execute the following trades:

- Sell 1 call option at ₹95 (ITM)

- Buy 2 call options at ₹100 (ATM)

- Sell 1 call option at ₹105 (OTM)

If XYZ moves significantly above ₹105 or below ₹95, the strategy achieves maximum profit.

Key Takeaways

- Volatility Strategy: Best for markets where large price movements are expected.

- Limited Risk: Maximum loss is capped.

- Higher Reward Potential: Profits from large moves in either direction.

- Time Decay Risk: Since short options are involved, time decay works against the position.

Payoff Structure of Short Butterfly Spread

- Maximum Profit: Occurs when the underlying price moves far away from the middle strike price.

- Maximum Loss: Occurs if the price stays near the middle strike price at expiration.

- Break-even Points: Two break-even levels exist:

- Lower Break-even = Lower Strike – Net Premium Received

- Upper Break-even = Higher Strike + Net Premium Received

Advantages of a Short Butterfly Spread

- High Reward Potential: Can generate significant returns if volatility increases.

- Limited Risk: Maximum loss is predefined at entry.

- Profits from Large Price Moves: Ideal for uncertain or news-driven markets.

Risks and Considerations

- Time Decay Works Against You: The middle strike short options lose value slowly, impacting profits.

- Margin Requirements: Higher compared to a Long Butterfly.

- Liquidity Issues: Execution might be difficult in illiquid markets.

Step-by-Step Implementation in Algomojo

With Algomojo, traders can efficiently execute a Short Butterfly Spread. Here’s how:

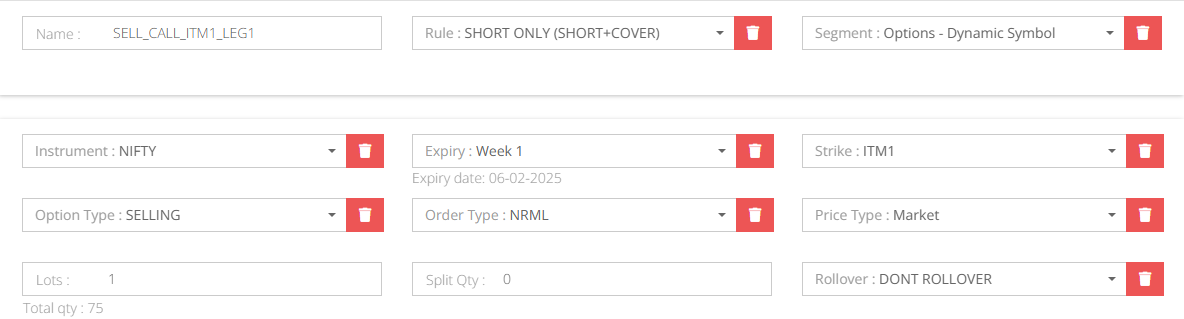

1. Create a Sell Call (ITM) Order

- Path: My Strategy => New Strategy

- Select an expiration date and an in-the-money (ITM) call option to sell.

2. Create a Buy Call (ATM) Order

- Path: My Strategy => New Strategy

- Select an at-the-money (ATM) call option and buy two contracts.

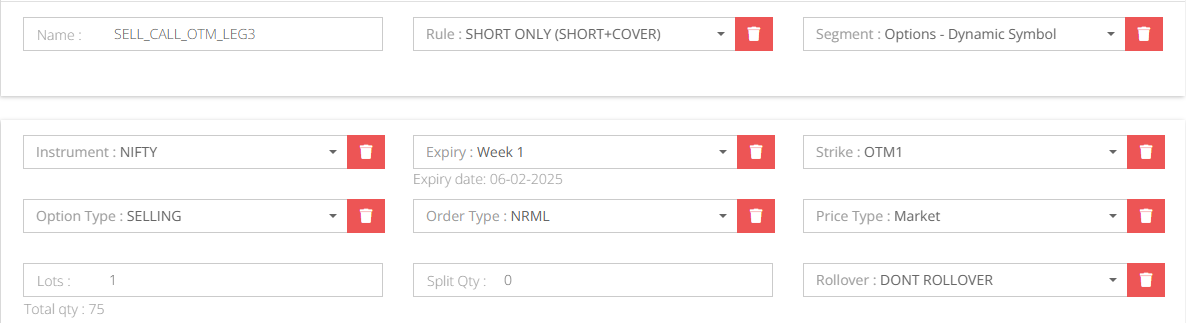

3. Create a Sell Call (OTM) Order

- Path: My Strategy => New Strategy

- Select an out-of-the-money (OTM) call option to sell.

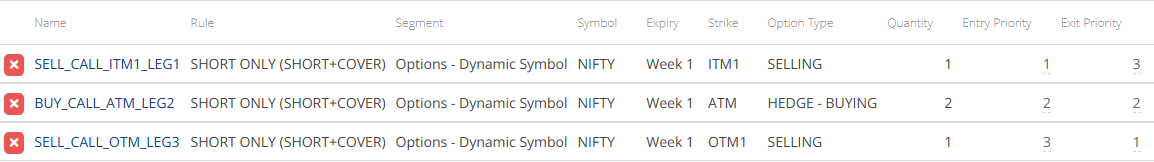

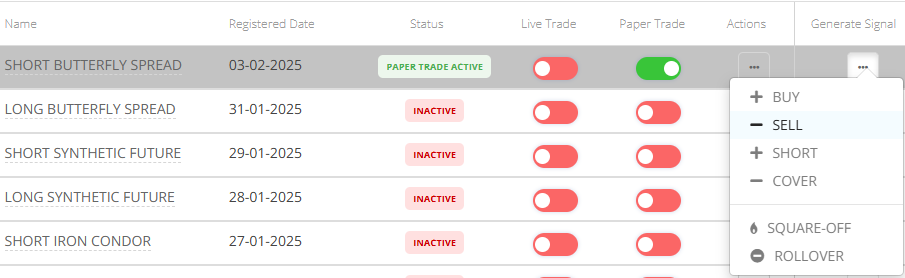

4. Group Your Strategy

- Path: My Group Strategy => New Group Strategy

- Combine the three legs into a single strategy group.

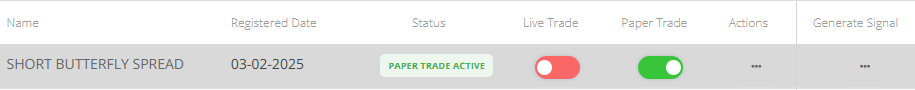

5. Enable Paper Trade Mode

- Path: My Group Strategy

- Enable Paper Trade mode to test the strategy before executing it live.

6. Generate SELL Signal to Open the Trade

- Path: My Group Strategy

- Execute a SELL signal to enter the Short Butterfly Spread.

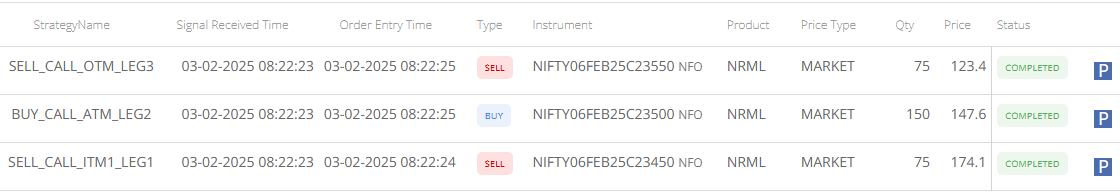

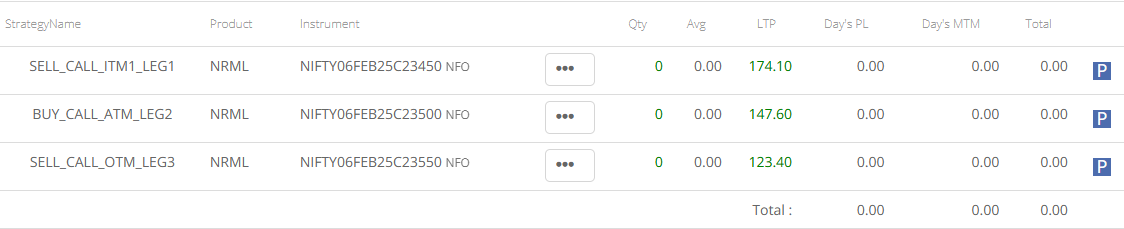

7. Executed Paper Trade Orders

- Path: My Group Signals => Orders

- Ensure all contracts have been filled at your intended strike and expiration.

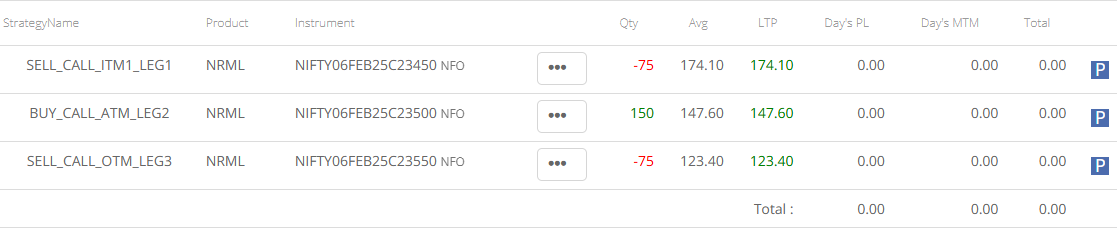

8. Monitor Open Positions

- Path: My Group Signals => Positions

- Track how the underlying price moves relative to the middle strike.

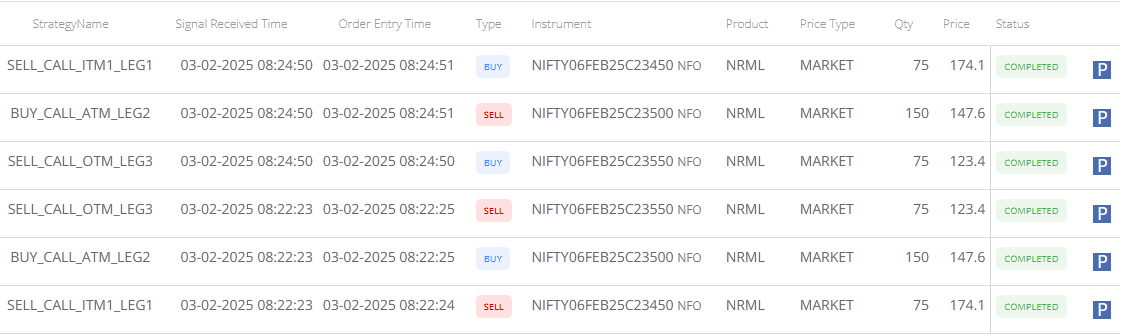

9. Generate BUY Signal to Exit

- Path: My Group Strategy

- If the price moves significantly, trigger a BUY signal to close the trade.

10. Confirm Closing Orders

- Path: My Group Signals => Orders

- Ensure all contracts have been properly closed.

11. Review Trade Performance

- Path: My Group Signals => Positions

- Evaluate profit/loss and assess market conditions.

Frequently Asked Questions (FAQ)

Is a Short Butterfly Spread better than a Long Butterfly Spread?

It depends on market conditions. A Short Butterfly is ideal for high volatility, while a Long Butterfly works best in low volatility markets.

What happens if the stock stays near the middle strike price?

The maximum loss occurs, as all options expire with minimal value.

Can I use Put options for a Short Butterfly Spread?

Yes, you can create a Short Put Butterfly Spread instead of using calls.

Does this strategy work for low volatility markets?

No, the Short Butterfly Spread is best for high volatility conditions.

Can I execute this strategy manually?

Yes, but Algomojo automates execution, reducing manual errors.

Final Thoughts

The Short Butterfly Spread is an excellent strategy for traders expecting high volatility. It offers limited risk with the potential for high rewards if the underlying asset moves significantly. By using Algomojo, traders can efficiently execute, track, and refine this strategy with automated multi-leg execution and real-time monitoring.

Have you tried a Short Butterfly Spread before? Share your experience in the comments!

Pingback: Short Put Butterfly Spread: A Profitable Neutral Options Strategy – algomojo – Automated Trading Platform for Smarter Algorithmic Trading