Introduction

The Put Ratio Spread is an advanced options trading strategy designed for traders who anticipate a moderate decline in the underlying stock or index while keeping the cost of the trade low. This strategy offers a balance between risk and reward by combining long put options with short put options in a higher ratio.

Put Ratio Spreads work best in low-volatility markets where traders expect a steady downside move without extreme fluctuations. This strategy is often structured as a near-zero-cost or small-credit trade, making it attractive for traders looking to optimize risk-reward dynamics.

In this blog, we will explore how the Put Ratio Spread strategy works, its risk-reward characteristics, and how to execute it efficiently using Algomojo.

What is a Put Ratio Spread?

A Put Ratio Spread consists of:

✔ Buying a smaller number of at-the-money (ATM) or in-the-money (ITM) put options (higher premium paid)

✔ Selling a larger number of out-of-the-money (OTM) put options (lower premium collected)

This structure helps reduce the overall cost of the trade and can sometimes generate a net credit, making it a cost-efficient bearish strategy.

Structure of a Put Ratio Spread

The strategy consists of two trades:

1️⃣ Buy 1 ATM or ITM Put Option (Long Leg)

2️⃣ Sell 2 OTM Put Options (Short Legs)

This creates a directional trade that benefits from moderate downward movements while having a defined risk on the upside.

Example of a Put Ratio Spread

Assume Stock XYZ is trading at ₹1000. You execute the following trades:

- Buy 1 ATM Put (Strike Price: ₹1000) at ₹50

- Sell 2 OTM Puts (Strike Price: ₹950) at ₹25 each

📌 Net premium paid: ₹50 – (₹25 × 2) = ₹0 (Zero Cost Trade!)

Possible Outcome Scenarios:

| Stock Price at Expiry | Profit/Loss | Explanation |

|---|---|---|

| ₹1000 (No Move) | Small loss | Time decay affects the long put. |

| ₹950 (Moderate Move) | Maximum Profit | The short puts expire worthless while the long put gains value. |

| ₹900 or Below (Strong Move) | Unlimited Loss | Losses increase as short puts become deep ITM. |

Key Takeaways

✅ Limited Risk – Maximum loss occurs beyond the breakeven point.

✅ Limited Profit – Best profit occurs at the sold strike price.

✅ Volatility Considerations – Works best in low-volatility environments.

✅ Cost-Efficient – Can be structured as a near-zero-cost trade.

Payoff Structure of a Put Ratio Spread

| Scenario | Impact |

| Price remains stagnant | ❌ Small loss due to time decay |

| Price moves down moderately | ✅ Maximum profit potential |

| Price drops significantly | ❌ Unlimited loss (if unhedged) |

| Volatility increases | ❌ Can increase losses |

| Volatility decreases | ✅ Beneficial since short options lose value |

Advantages of a Put Ratio Spread

📉 Cost-Effective – Reduces the net premium paid or even generates a small credit.

📈 Limited Risk (Up to Breakeven) – If the stock moves slightly downward, it is a profitable trade.

⚡ Works in Low Volatility – Unlike the Put Backspread, this strategy is best suited for low volatility markets.

💰 Customizable Strategy – You can modify the ratio (e.g., 1:3 or 2:3) to fit market conditions.

Risks and Considerations

❌ Unlimited Loss Beyond Breakeven – If the stock price falls too much, the short puts create large losses.

❌ Limited Profit Potential – The best profit occurs at the short put strike, after which profits diminish.

❌ Margin Requirements – Requires higher margin compared to simple spreads due to uncovered short puts.

Step-by-Step Implementation in Algomojo

With Algomojo, traders can seamlessly execute Put Ratio Spread strategies using automated order placement and execution.

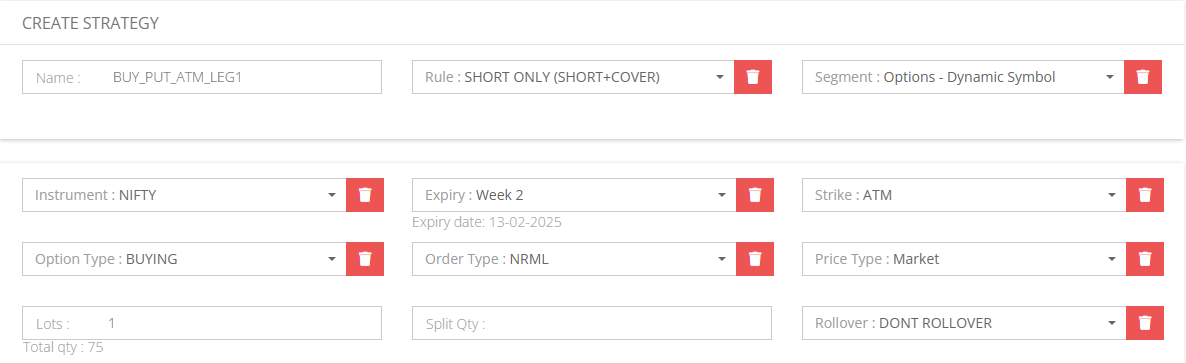

1. Create a Buy ATM Put for Long Leg (Leg 1)

📍 Path: My Strategy → New Strategy

✔ Choose a near-the-money strike price.

✔ Select the ATM or ITM put option with the correct expiration.

✔ Verify lot size and margin requirements.

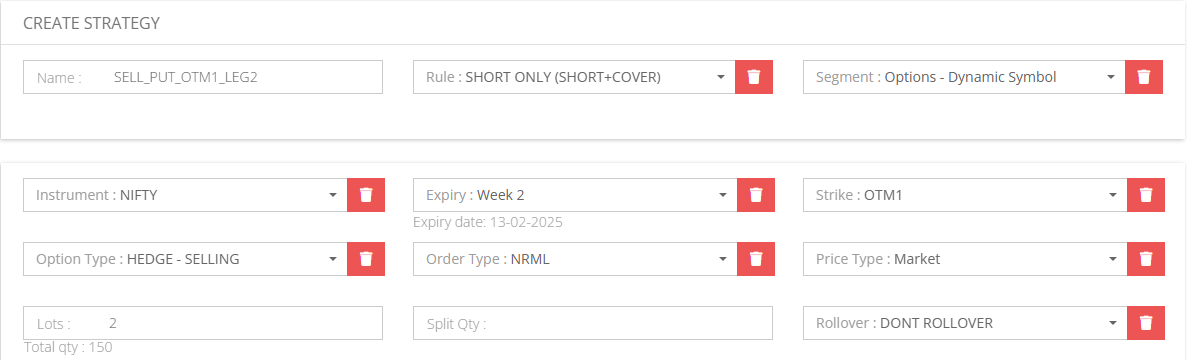

2. Create a Sell 2 OTM Puts for Short Leg (Leg 2)

📍 Path: My Strategy → New Strategy

✔ Choose a lower strike price than the long put.

✔ Sell 2 OTM put options.

✔ Ensure correct lot size and margin allocation.

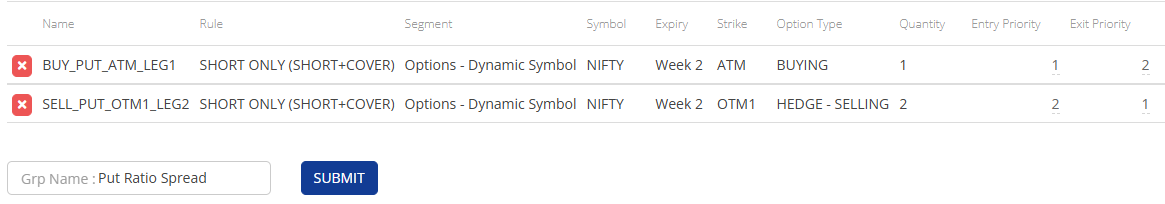

3. Group the Strategy

📍 Path: My Group Strategy → New Group Strategy

✔ Combine both legs into a single Put Ratio Spread.

✔ Name the strategy for easy identification.

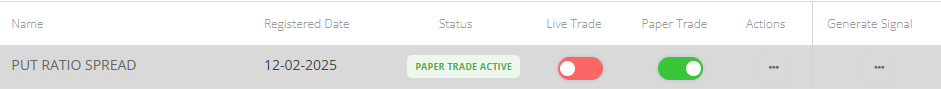

4. Enable Paper Trade Mode

📍 Path: My Group Strategy

✔ Test the strategy before deploying it in live markets.

✔ Simulate market conditions to observe behavior.

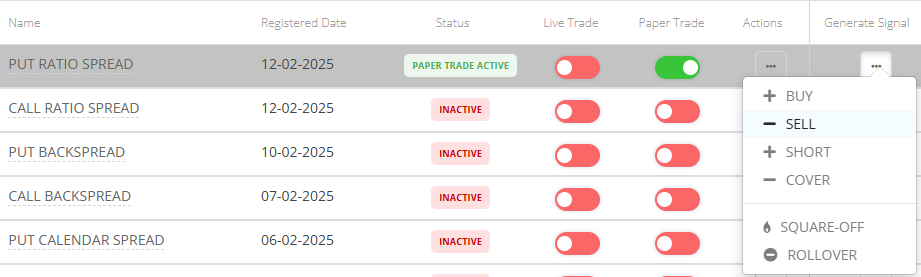

5. Generate a SELL Signal

📍 Path: My Group Strategy

✔ Click SELL to place both orders simultaneously.

6. Executed Paper Trade Orders

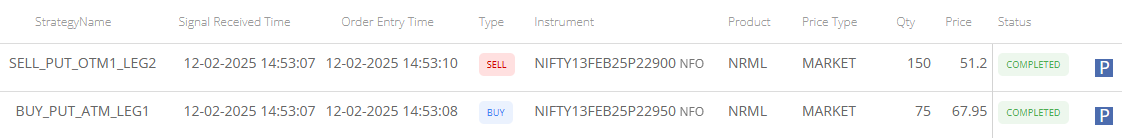

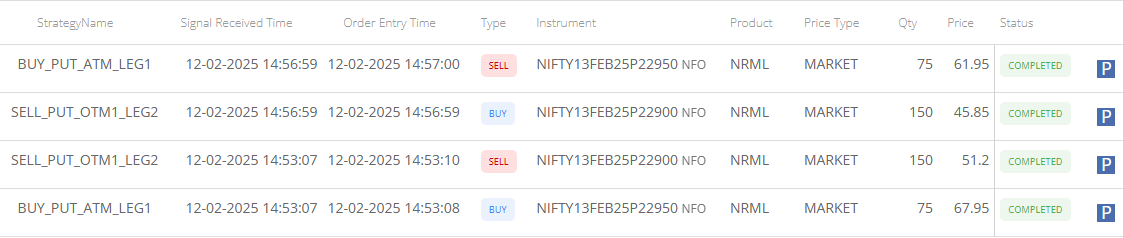

📍 Path: My Group Signals → Orders

✔ Verify that both legs are successfully placed in the Order Book.

✔ Ensure all contracts are filled at the intended strike and expiration.

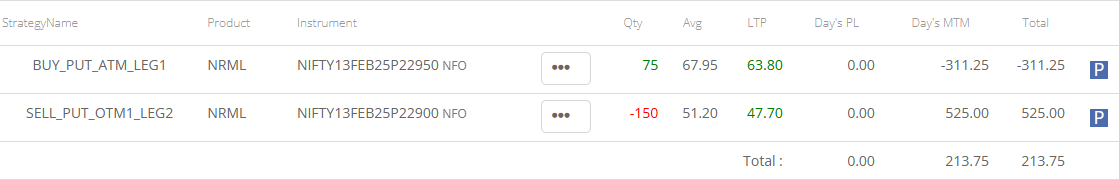

7. Monitor Open Positions

📍 Path: My Group Signals → Positions

✔ Track price movements and implied volatility (IV) changes.

✔ Monitor the time decay (Theta) effect.

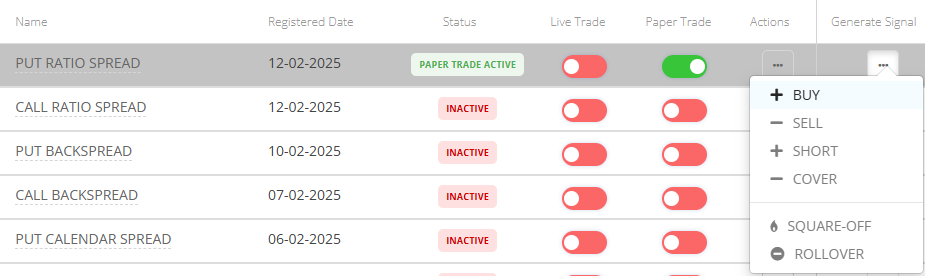

8. Generate a BUY Signal to Exit the Trade

📍 Path: My Group Strategy

✔ Exit the position if the stock reaches the desired profit target.

✔ Close the trade before expiration to capture gains.

9. Confirm Closing Orders

📍 Path: My Group Signals → Orders

✔ Ensure both legs are exited at the intended price.

✔ Validate the final PnL impact.

10. Review Trade Performance

📍 Path: My Group Signals → Positions

✔ Analyze profit/loss metrics.

✔ Optimize future Put Ratio Spread strategies based on insights.

Frequently Asked Questions (FAQ)

1️⃣ How is a Put Ratio Spread different from a Put Backspread?

📌 Put Ratio Spread: Limited profit and unlimited risk on downside.

📌 Put Backspread: Unlimited profit and limited risk.

2️⃣ What happens if the stock moves sideways?

📌 A small loss occurs due to time decay.

3️⃣ Can I execute a Put Ratio Spread with ITM options?

📌 Yes, but OTM options provide higher leverage.

4️⃣ Is this strategy suitable for high volatility markets?

📌 No, Put Ratio Spreads work best in low volatility environments.

Final Thoughts

The Put Ratio Spread Strategy is an excellent choice for traders looking to capitalize on a moderate bearish move while keeping costs low and risks manageable.

By using Algomojo, traders can efficiently execute, monitor, and refine this strategy with automated multi-leg execution and real-time tracking.

💡 Have you tried a Put Ratio Spread before? Share your experience in the comments! 🚀🔥