What is a Long Iron Condor?

A Long Iron Condor is a debit options strategy that aims to profit from large price moves in the underlying—either up or down—while limiting risk on both sides. It consists of four legs: two long options (one call and one put) and two short options (one call and one put), structured around two strikes in the middle and two further-out strikes. Unlike the more common short iron condor (which collects premium and profits from low volatility), the long version pays a net debit and benefits from higher volatility than the market anticipates.

Understanding the Long Iron Condor

How It Works

- Buy an OTM Put (Lower Strike)

- Sell a Put at a Higher Strike (closer to at-the-money)

- Sell a Call at an Even Higher Strike (closer to at-the-money)

- Buy an OTM Call (Upper Strike)

Visually, you have a call spread and a put spread, but you are buying both spreads. You pay a net debit for this setup. The goal is for the underlying price to move beyond the inner short strikes, either up or down, so one of the spreads gains enough value to exceed the total cost of the strategy.

Key Benefits

- Defined Risk: Your maximum loss is limited to the net debit (the amount you pay to open the condor).

- Potential for Profit in Both Directions: If the market makes a strong upward or downward move, the long spread on that side can become profitable.

- Limited Capital Requirement: Compared to naked long options, the margin needed is typically lower because each side is a defined spread.

Potential Drawbacks

- Loss if the Underlying Stays in the Middle: If the price remains between the two short strikes at expiration, both spreads remain mostly out-of-the-money, and you lose your net debit.

- Time Decay: Like any debit strategy, time decay works against you if the underlying fails to move quickly.

- Complexity: Four legs mean higher transaction costs and more complexity compared to simpler strategies.

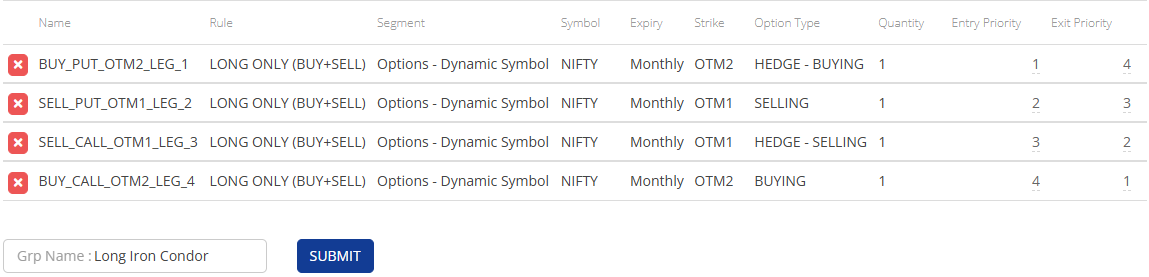

Step-by-Step Implementation in Algomojo

Below is a sample workflow for setting up a Long Iron Condor in Paper Trade mode. Adapt the strikes and expirations based on your market outlook and risk tolerance.

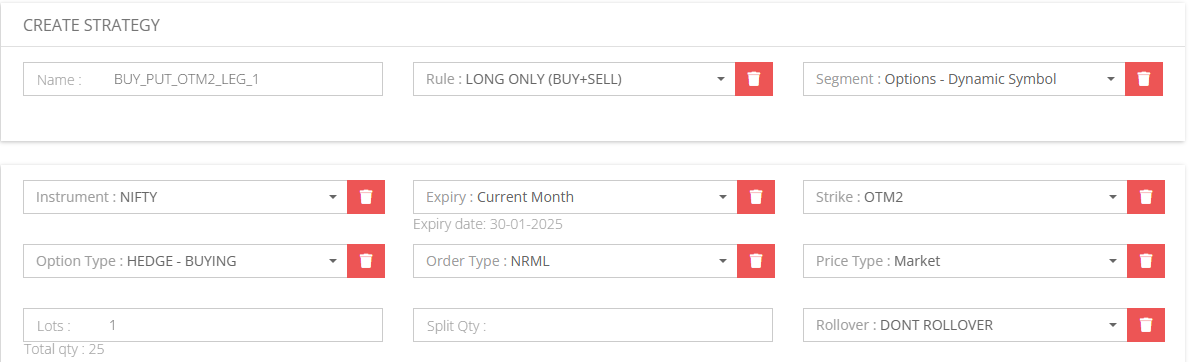

1. Create Buy OTM Put – Leg 1

- Path:

My Strategy => New Strategy - Configure a Buy Put at a lower strike (out-of-the-money).

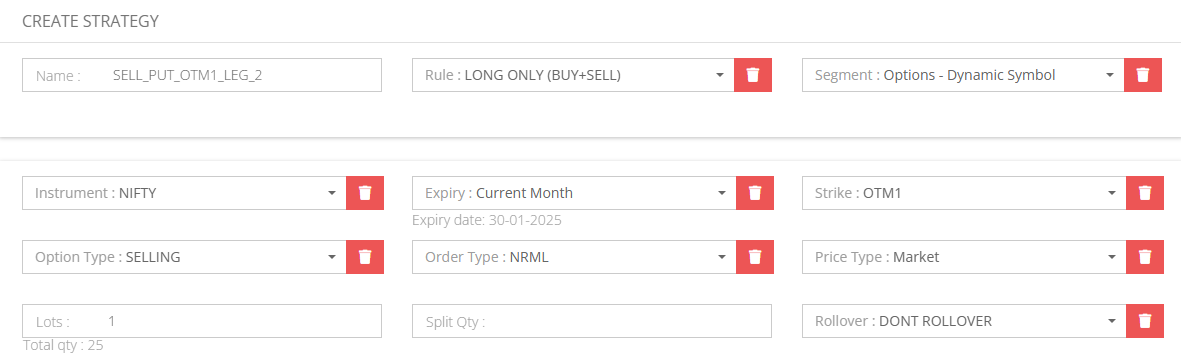

2. Create Sell Higher-Strike Put – Leg 2

- Path:

My Strategy => New Strategy - Configure a Sell Put at a strike closer to the current market price. This is the short put leg of your put spread.

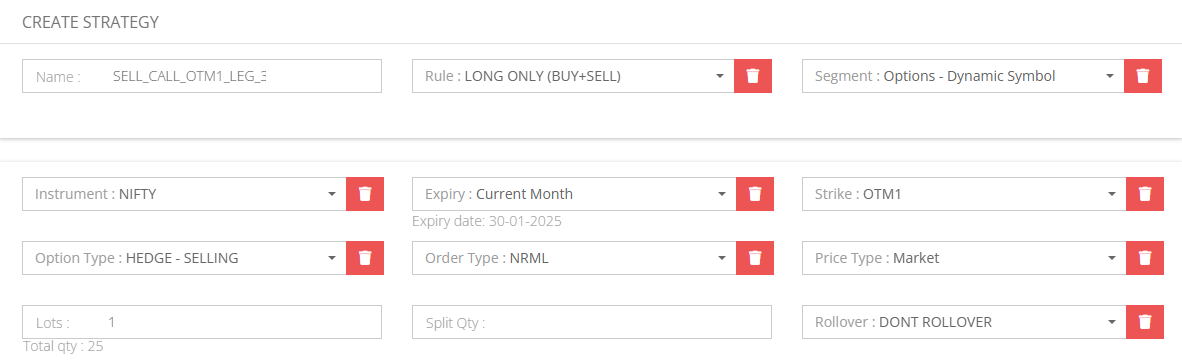

3. Create Sell Lower-Strike Call – Leg 3

- Path:

My Strategy => New Strategy - Configure a Sell Call at a strike just above the current market. This is the short call leg of your call spread.

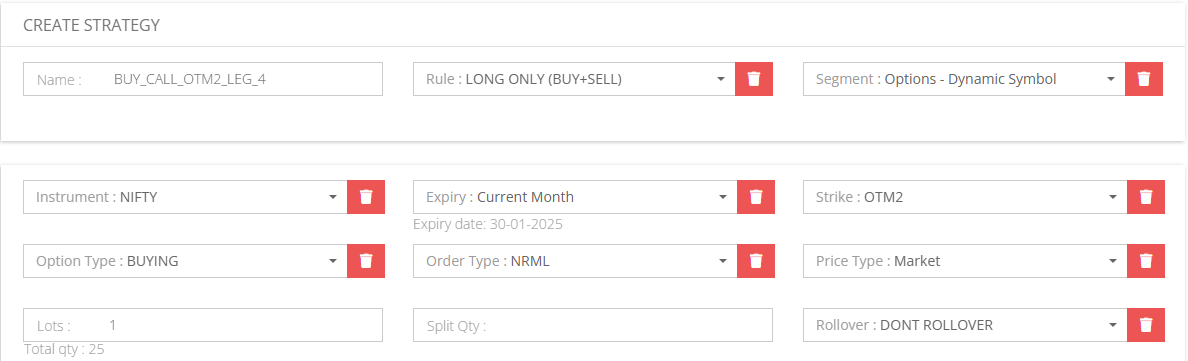

4. Create Buy OTM Call – Leg 4

- Path:

My Strategy => New Strategy - Configure a Buy Call at a higher strike, forming the long call spread on the upside.

Make sure all four options share the same expiration date.

5. Create a Group Strategy

- Path:

My Group Strategy => New Group Strategy - Combine these four legs into a single group so you can manage them as one Long Iron Condor strategy.

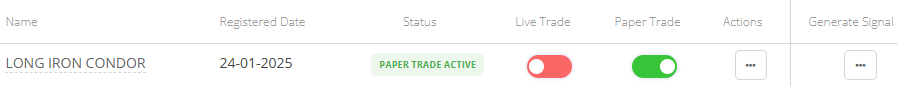

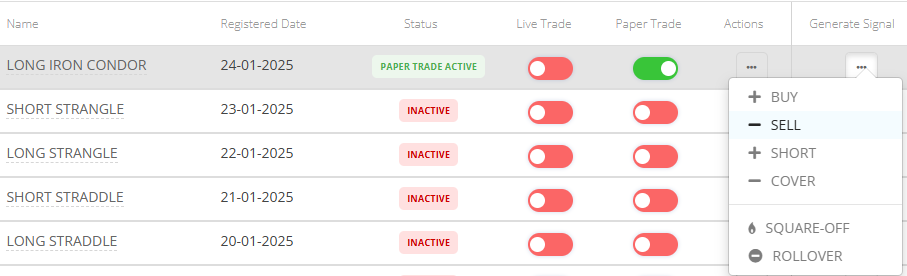

6. Switch on Paper Trade

- Path:

My Group Strategy - Toggle Paper Trade mode to test your setup risk-free before moving to live trades.

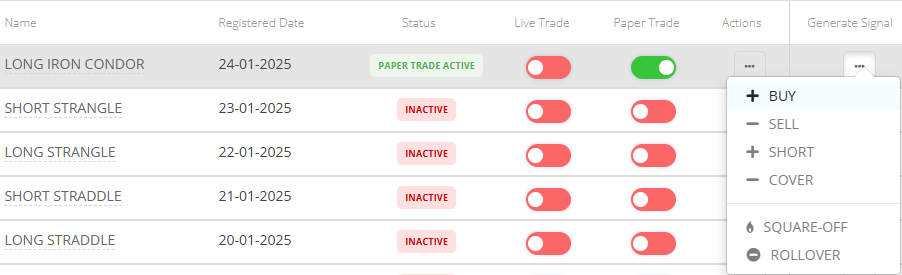

7. Generate BUY Signal

- Path:

My Group Strategy - When you anticipate increased volatility or significant moves in the underlying, trigger the BUY signal to open all four legs simultaneously.

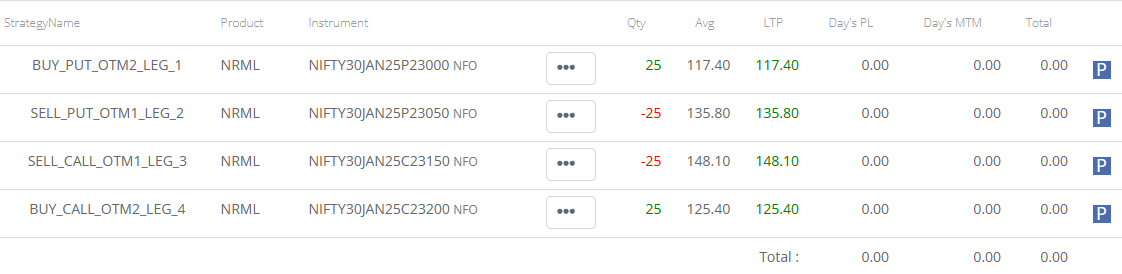

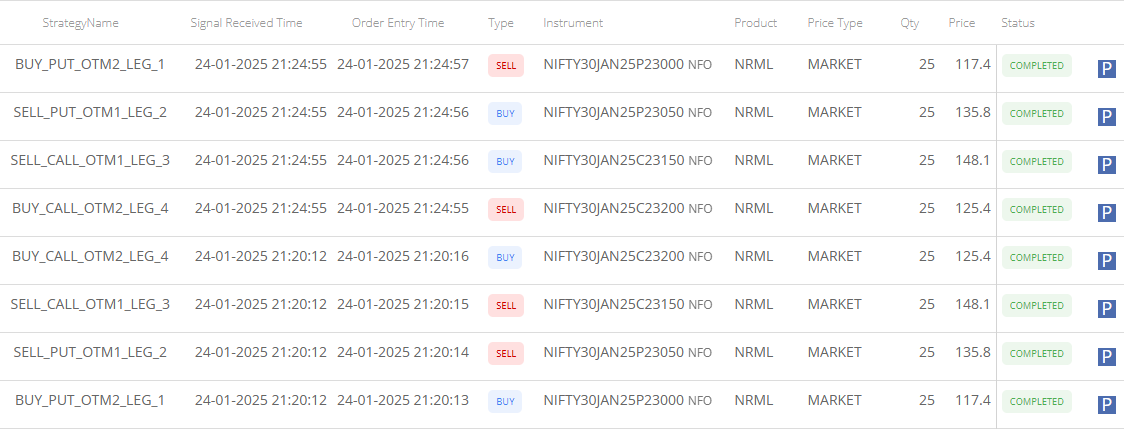

8. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Verify the net debit, strikes, and quantities match your intended Long Iron Condor setup.

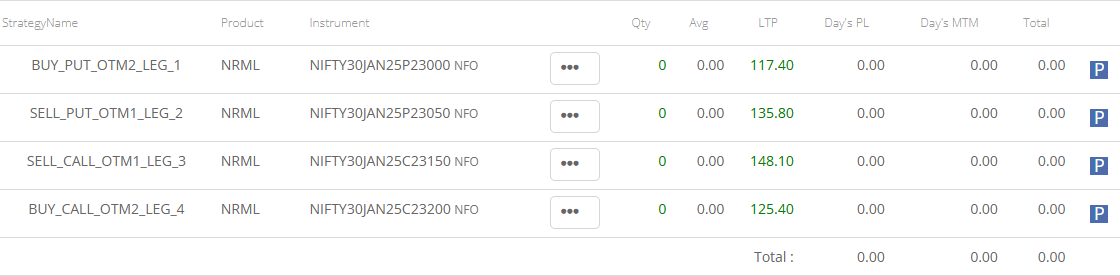

9. Positions after BUY Signal

- Path:

My Group Signals => Positions - Confirm your open position. Track the underlying price relative to the short strikes and watch for one of the spreads to become profitable if a strong move occurs.

10. Generate SELL Signal (to Close)

- Path:

My Group Strategy - If you’re ready to exit—perhaps after capturing a profit or if volatility didn’t materialize—initiate a SELL signal to close out all four legs.

11. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Ensure that each option leg is reversed (the short legs are bought back; the long legs are sold).

12. Positions after SELL Signal

- Path:

My Group Signals => Positions - Check you have no remaining open legs. If trading live, you can see real-time MTM and Realised Day’s P&L in this section.

Post-Trade Review

After the options expire or you close your position, analyze:

- Did the underlying move outside the short strikes enough to profit?

- Were your entry (and exit) signals timed effectively for expected volatility?

- Could alternative strikes or expirations have improved profitability or reduced cost?

Use these insights to refine your approach for future Long Iron Condors and other multi-leg options strategies.

Final Thoughts

A Long Iron Condor is a defined-risk, volatility-friendly strategy that lets you capitalize on large price swings while controlling potential losses. By automating order execution via Algomojo, you can concentrate on strategy development, risk assessment, and market analysis instead of manual trade placement. Keep in mind that Algomojo itself doesn’t provide or guarantee profitable signals—it executes your external instructions. Thorough backtesting, well-considered strike selection, and realistic volatility expectations are crucial for consistent results in options trading.

Happy Trading!

is it possible to trade in equity intra day and positional. also, i want your support to trade with futures with option hedging.

Everything is possible, Please send your requirement to support@algomojo.com, or send whatsapp message to Algomojo WhatsApp