Introduction

A Short Synthetic Future is an options strategy that replicates shorting a futures contract using call and put options. By simultaneously selling a call and buying a put at the same strike price and expiration date, traders can mimic the payoff of being “short” the underlying. This strategy is useful for traders who anticipate a decline in the asset’s price and want to benefit from leveraged exposure while optimizing margin efficiency.

What is a Short Synthetic Future?

A Short Synthetic Future mirrors the price movement of a short futures contract without directly shorting the future itself. Specifically, a short synthetic is constructed by:

- Selling a Call Option at a particular strike price.

- Buying a Put Option at the same strike price (and expiration date).

If executed at or near-the-money, this combination behaves similarly to a short futures position: the strategy profits when the underlying price falls and incurs losses when the price rises.

Key Takeaway

Short Synthetic Future = Short Call + Long Put at the same strike and expiration.

This combination closely replicates the delta (price sensitivity) of the underlying asset, providing a futures-like exposure with different capital or margin requirements compared to shorting a futures contract directly.

Understanding the Short Synthetic Future

How It Works

Sell Call (Short Call Leg):

- Obligation to sell the underlying at the strike price if exercised.

- If the market rises, this call loses value, leading to potential losses.

Buy Put (Long Put Leg):

- Right to sell the underlying at the strike price.

- If the market falls, this put gains value, providing profit.

When both positions are combined at the same strike and expiration, the net result is that the position behaves like a short futures contract.

Key Benefits

- Lower Capital Requirement: The margin for a short synthetic future is often lower than shorting an actual futures contract, depending on broker rules.

- Flexibility: The strategy allows traders to customize strike price and expiration to match market outlook.

- No Direct Short Selling: Traders can replicate a short position without actually borrowing the underlying asset.

Potential Drawbacks

- Assignment Risk (Short Call Leg): If the underlying price moves above the strike, you may be assigned early on the short call.

- Margin Requirements: You still need sufficient margin to cover potential losses on the short call.

- Implied Volatility Effects: Changes in implied volatility can impact the value of both legs differently, leading to temporary deviations from the futures replication.

Step-by-Step Implementation (Example in Algomojo)

Below is a sample workflow for setting up a Short Synthetic Future in Paper Trade mode. Adapt strike prices and expirations based on market outlook and option liquidity.

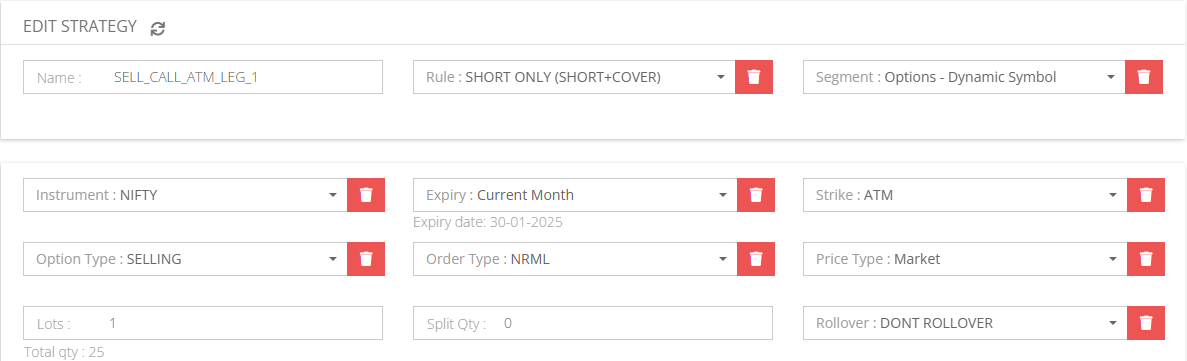

1. Create Sell Call (Short Call Leg)

- Path: My Strategy => New Strategy

- Select an expiration date and strike price at or near the current underlying price.

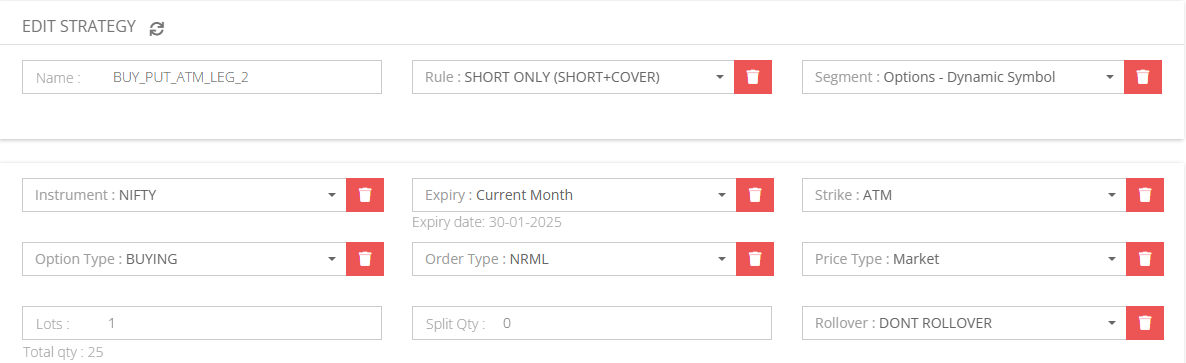

2. Create Buy Put (Long Put Leg)

- Path: My Strategy => New Strategy

- Use the same expiration date and strike as the short call.

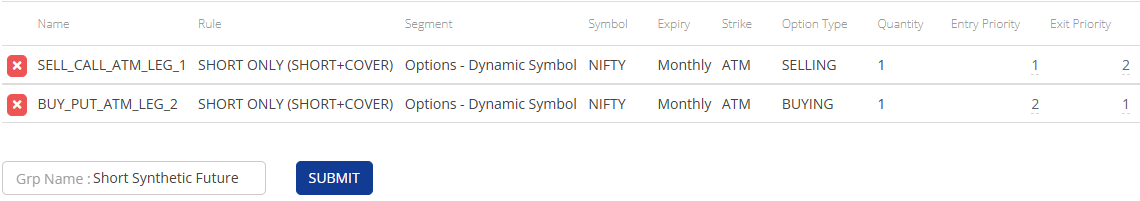

3. Group Your Strategy

- Path: My Group Strategy => New Group Strategy

- Combine the short call and long put into a single group (Short Synthetic Future).

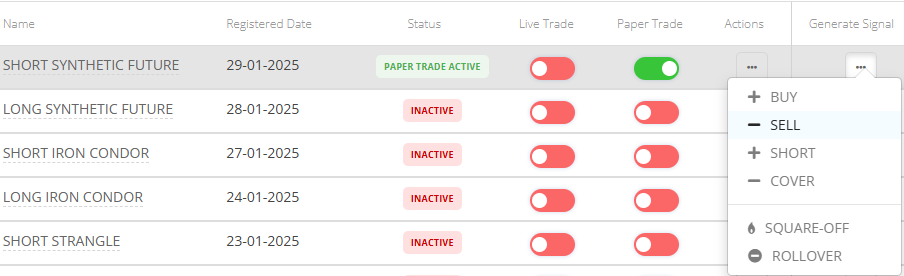

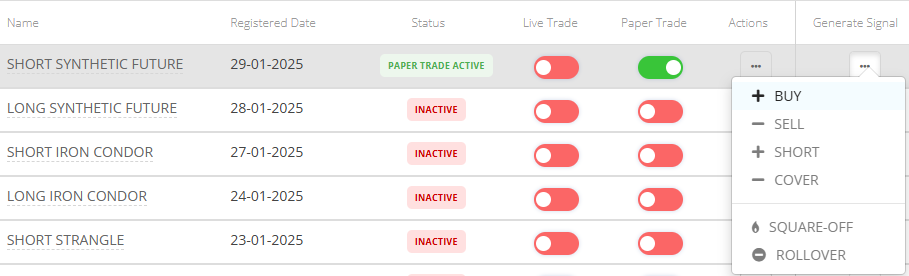

4. Enable Paper Trade Mode

- Path: My Group Strategy

- Turn on Paper Trade mode to simulate the strategy before live execution.

5. Generate SELL Signal

- Path: My Group Strategy

- If bearish on the underlying, trigger a SELL signal to enter both legs simultaneously.

6. Confirm Executed Orders

- Path: My Group Signals => Orders

- Ensure both options were entered at the intended strike and expiration.

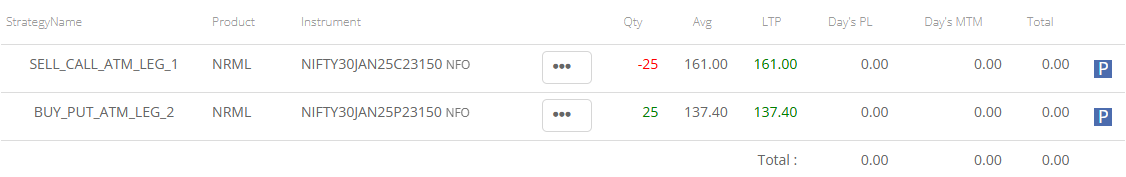

7. Monitor Open Positions

- Path: My Group Signals => Positions

- Track the underlying’s price movement relative to the strike price.

8. Generate BUY Signal to Exit

- Path: My Group Strategy

- Close both legs by triggering a BUY signal when the profit target is reached or the market view changes.

9. Confirm Closing Orders

- Path: My Group Signals => Orders

- Ensure both legs were exited correctly.

10. Post-Trade Review

- Analyze market movement vs. expected performance.

- Review how changes in implied volatility affected the position.

- Optimize strike selection and expiry for future trades.

Frequently Asked Questions (FAQ)

How is a Short Synthetic Future different from shorting a futures contract outright?

A synthetic future replicates a futures position using options, often with different margin and risk considerations. Shorting a future involves direct exposure to the asset’s price movement, while the synthetic approach uses option premiums and volatility effects.

What if the short call gets assigned early?

If assigned early, you will be obligated to sell the underlying at the strike price. The long put remains, so you can either hold the short underlying position or close the put to offset the exposure.

Does implied volatility impact the strategy?

Yes, a short synthetic future can be affected by implied volatility shifts, which may alter the price behavior compared to a direct futures contract.

Is a Short Synthetic Future always cheaper than shorting the underlying directly?

Not necessarily. The net credit or debit depends on market conditions, implied volatility, and margin requirements.

When should I use a Short Synthetic Future instead of directly shorting the asset?

If margin conditions are favorable, a synthetic short can be a cost-effective way to replicate a short position without borrowing the asset.

Final Thoughts

A Short Synthetic Future is a powerful alternative to shorting futures or underlying assets directly. By using options, traders can construct a short position with potential margin benefits and strategic flexibility. However, assignment risk and volatility effects must be carefully managed. Platforms like Algomojo provide the ability to execute, monitor, and refine multi-leg strategies efficiently. As always, strong risk management and market analysis are key to success.

Happy Trading!