What is a Short Strangle?

A Short Strangle is an options strategy where you sell an out-of-the-money (OTM) call and sell an out-of-the-money (OTM) put, both with the same expiration date but different strike prices. Similar to a Short Straddle, the goal is to profit from low volatility and time decay—you expect the underlying price to stay within a range defined by the strikes of the short call and short put.

Understanding the Short Strangle

How It Works

- Sell an OTM Call: A call option whose strike price is above the current market price of the underlying.

- Sell an OTM Put: A put option whose strike price is below the current market price of the underlying.

By selling both options, you collect two premiums up front. You can potentially profit if the underlying stays between the two strikes until expiration. However, a big move to either the upside or downside could result in significant losses, since you have two short option positions.

Key Benefits

• Immediate Premium Income: You collect premium from both the call and put at initiation.

• Wider Range of Profit: Compared to a Short Straddle, an OTM Short Strangle may have more “breathing room” before the underlying hits either strike.

• Favorable Time Decay: As long as the underlying remains between the strikes, time erosion typically works in your favor.

Potential Drawbacks

• Significant Risk: If the underlying price moves beyond either strike, losses can pile up quickly.

• Margin Requirements: Brokers often require higher margin for short options strategies with substantial risk potential.

• Requires Low Volatility: If volatility increases or a large price swing occurs, the short options can inflate in value, resulting in losses.

Step-by-Step Implementation in Algomojo

Below is an example workflow to set up a Short Strangle in Paper Trade mode. Adjust your chosen strikes, expiration, and quantities based on your personal market outlook and risk tolerance.

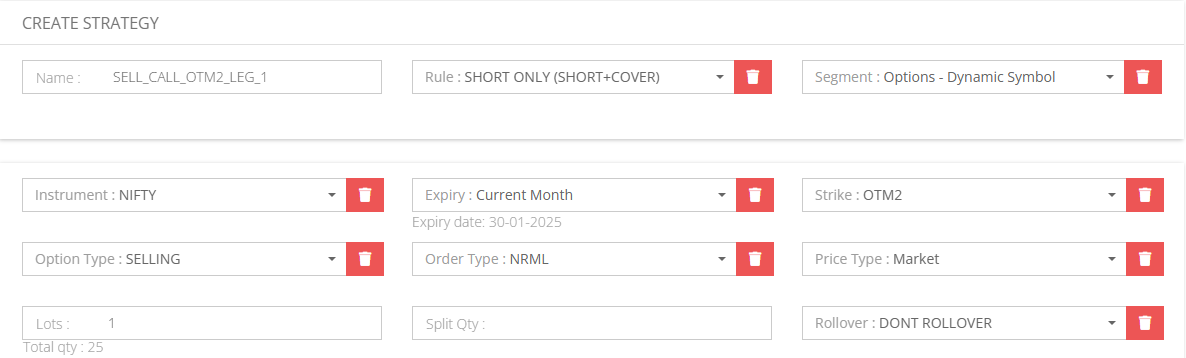

1. Create Sell OTM Call – Leg 1

• Path: My Strategy => New Strategy

• Configure a Sell Call option with a strike price above the current market (OTM).

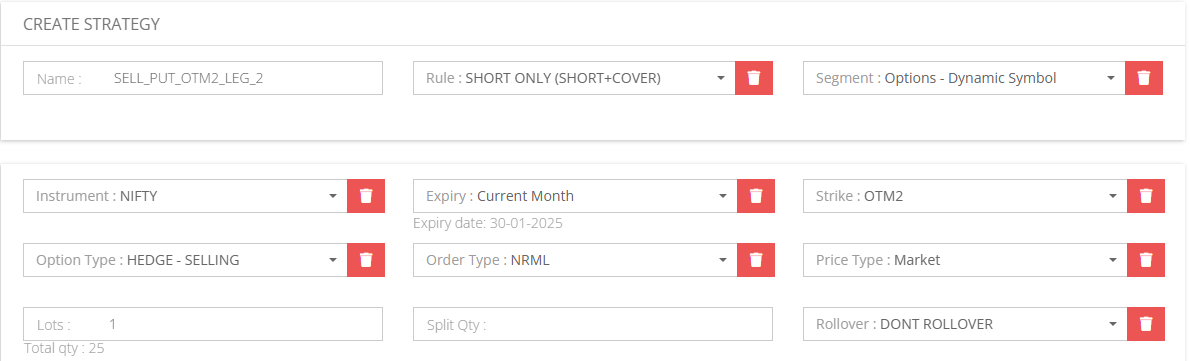

2. Create Sell OTM Put – Leg 2

• Path: My Strategy => New Strategy

• Configure a Sell Put option with a strike price below the current market (OTM), matching the same expiration as the short call.

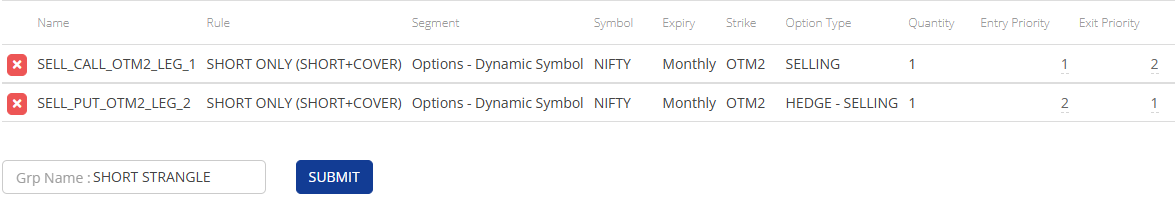

3. Create a Group Strategy

• Path: My Group Strategy => New Group Strategy

• Combine both legs (Sell OTM Call and Sell OTM Put) into a single group so they can be triggered together.

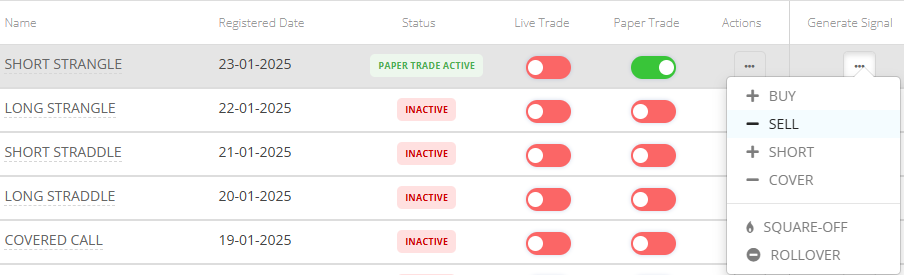

4. Switch on Paper Trade

• Path: My Group Strategy

• Enable Paper Trade mode to simulate your Short Strangle without financial risk. This helps you validate the logic before going live.

5. Generate SELL Signal

• Path: My Group Strategy

• When your analysis suggests the underlying is likely to remain range-bound, trigger the SELL signal to open both short legs simultaneously.

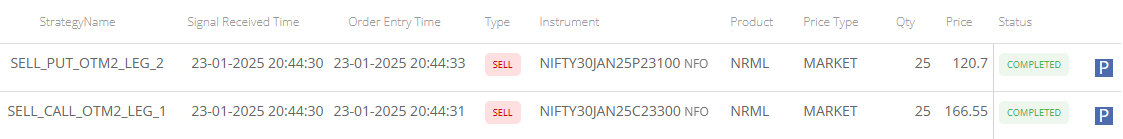

6. Executed Paper Trade Orders

• Path: My Group Signals => Orders

• Verify that the short call and short put were executed at your desired strikes and quantities.

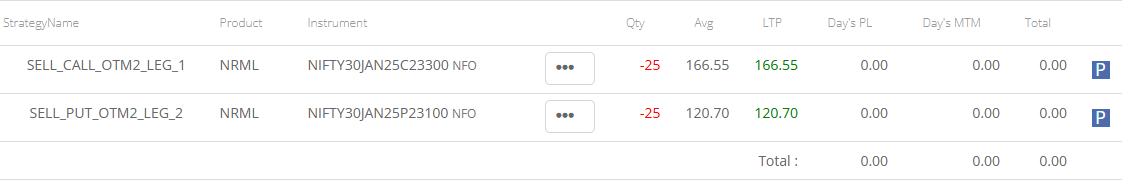

7. Positions after SELL Signal

• Path: My Group Signals => Positions

• Confirm your open Short Strangle positions and monitor your collected premium.

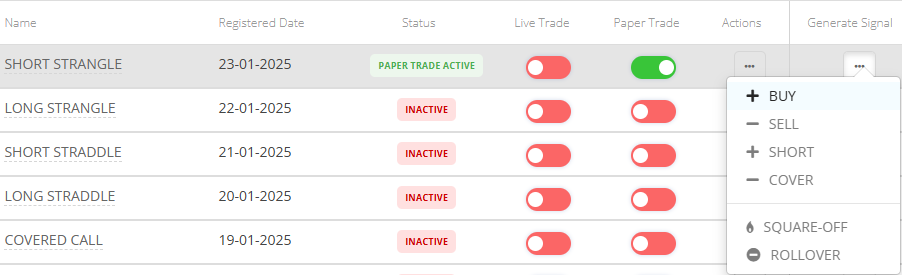

8. Generate BUY Signal (to Close)

• Path: My Group Strategy

• If you want to close early—after capturing most of the premium or to limit potential losses—initiate a BUY signal to purchase back both options.

9. Executed Paper Trade Orders

• Path: My Group Signals => Orders

• Ensure that both the call and put are bought back, finalizing your profit or loss.

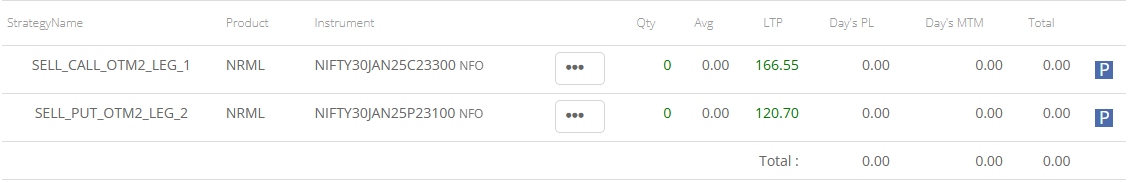

10. Positions after BUY Signal

• Path: My Group Signals => Positions

• Verify that no open legs remain. If you were live trading, you could check real-time MTM and Realised Day’s P&L to see the outcome.

Post-Trade Review

After the options expire or you exit the trade:

- Did the underlying stay within your expected range?

- Were entry and exit timings appropriate for the volatility environment?

- Could you refine strike selection or expiration dates to improve results next time?

Use these insights to adjust your future Short Strangle strategies and refine your approach to collecting premium.

Final Thoughts

A Short Strangle can be a profitable strategy in low-volatility, range-bound markets, offering premium income and a wider profit window than a Short Straddle. However, it also comes with substantial risk if the underlying moves beyond either strike. By automating order execution through Algomojo, you can reduce manual errors and devote more time to strategy development and risk analysis. Keep in mind that Algomojo does not generate or guarantee profitable signals—it simply executes your external strategies. Thorough testing, sound risk management, and consistent market evaluation are vital to success.

Happy Trading!