A Short Iron Condor is an options strategy that profits from a range-bound market while limiting risk on both the upside and downside. It involves selling two options (a call and a put) closer to the current market price, and buying two options further out-of-the-money to cap the maximum loss. This guide will explain how the strategy works, how you can implement it in Algomojo, and provide tips on managing your position and learning from your trades.

What is a Short Iron Condor?

A Short Iron Condor is constructed by combining two credit spreads—a call spread above the current price and a put spread below it. You collect premium by selling the near strikes (one call, one put) and simultaneously buy the farther strikes (another call, another put). If the underlying remains within a certain price range until expiration, the sold options expire worthless and you keep the net credit.

Key Points

- Credit Strategy

You receive premium upfront for selling the options. - Range-Bound Outlook

You want the underlying to trade between the short call strike and the short put strike by expiration. - Defined Risk

The long options (further OTM) limit your potential losses on both sides.

Understanding the Short Iron Condor

How It Works

- Sell a Call Option close to at-the-money (slightly above current price).

- Buy a Call Option further out-of-the-money (above the short call strike).

- Sell a Put Option close to at-the-money (slightly below current price).

- Buy a Put Option further out-of-the-money (below the short put strike).

These four legs form a “condor” shape on the payoff diagram, with your maximum profit being the net credit received. As long as the underlying does not break above your short call strike or below your short put strike, you can profit.

Key Benefits

- Defined Risk: Buying outer options caps your maximum loss on both sides.

- Range-Bound Profit: If the underlying stays within a specific zone, you keep the net credit at expiration.

- Flexibility: You can widen or narrow the distance between strikes to adjust your potential reward, probability of profit, and risk profile.

Potential Drawbacks

- Limited Profit: The maximum profit is the net premium collected upfront, no matter how placid the underlying stays.

- Complexity: Four option legs mean more moving parts and potentially higher commission costs.

- Loss if a Breakout Occurs: If the underlying price moves beyond the short strikes, the strategy can incur losses (though these are capped).

Step-by-Step Implementation in Algomojo

Below is an example workflow for setting up a Short Iron Condor in Paper Trade mode. Adjust the specific strikes and expirations based on your market outlook, risk tolerance, and volatility assumptions.

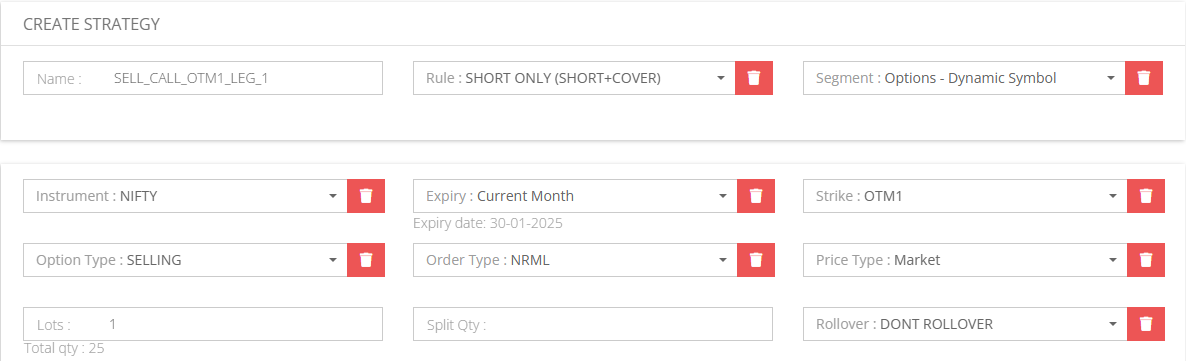

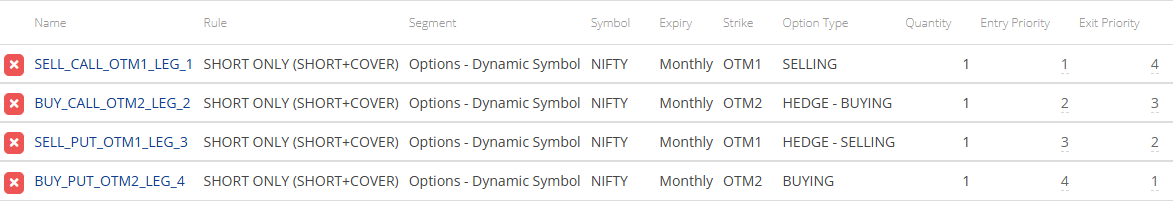

1. Create Sell Call & Buy Call (Call Spread)

- Sell Call (short call leg)

- Path:

My Strategy => New Strategy - Choose a strike above the current market price.

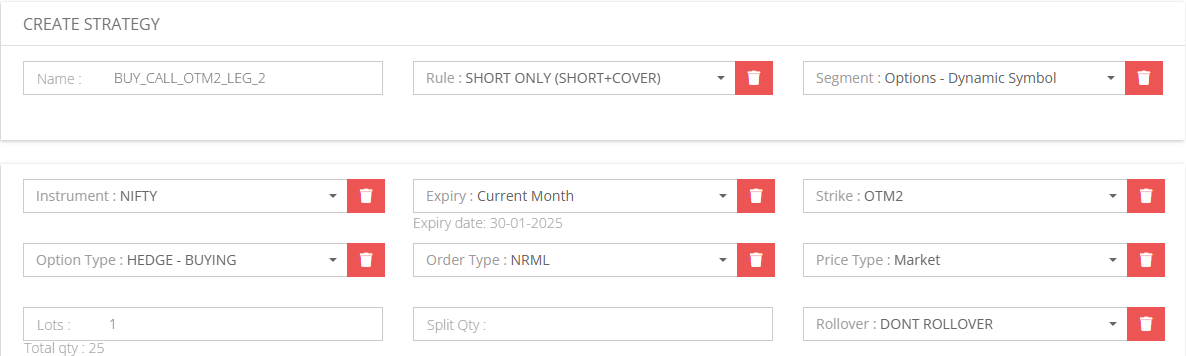

2. Buy Call (long call leg)

- Path:

My Strategy => New Strategy - Choose a strike further OTM than the short call, capping risk.

2. Create Sell Put & Buy Put (Put Spread)

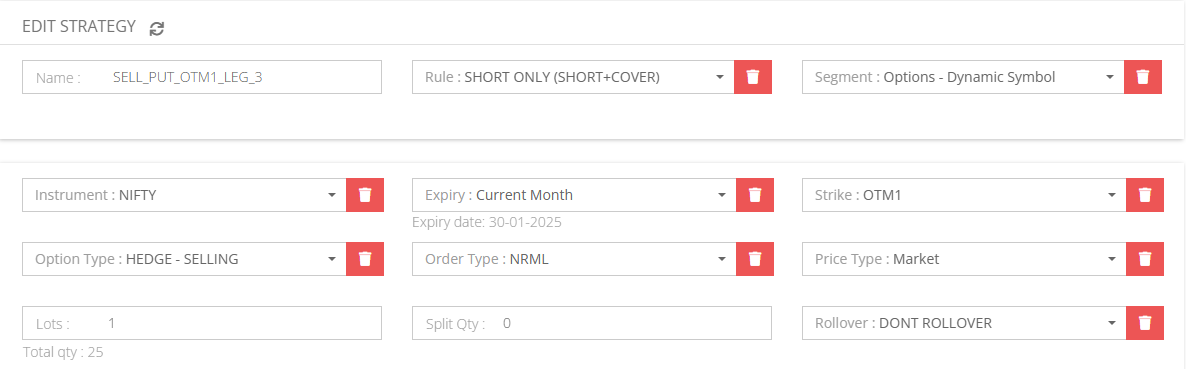

- Sell Put (short put leg)

- Path:

My Strategy => New Strategy - Choose a strike below the current market price.

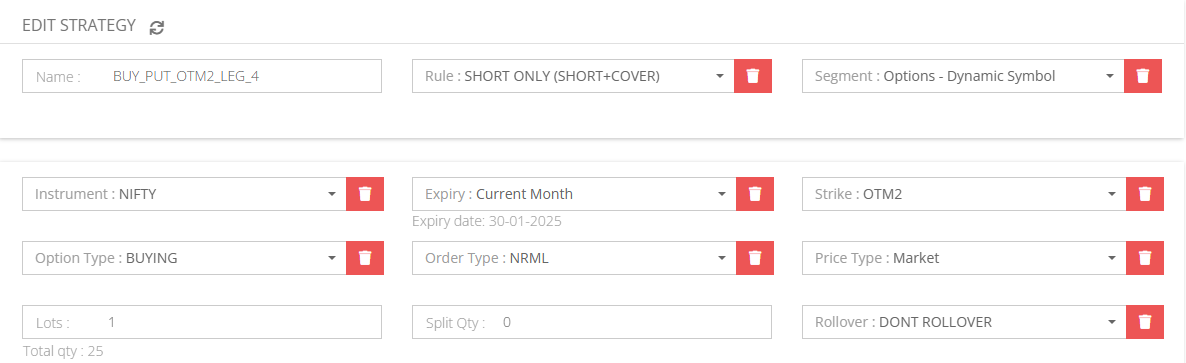

2. Buy Put (long put leg)

- Path:

My Strategy => New Strategy - Choose a lower strike (further OTM) to cap downside risk.

Make sure all four options share the same expiration date so they form a cohesive Iron Condor.

3. Create a Group Strategy

- Path:

My Group Strategy => New Group Strategy - Combine these four legs (2 calls + 2 puts) into one group representing the entire Short Iron Condor.

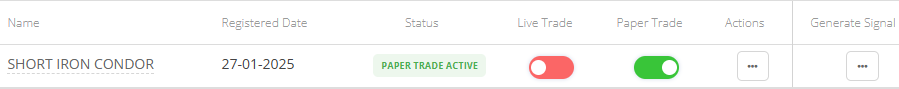

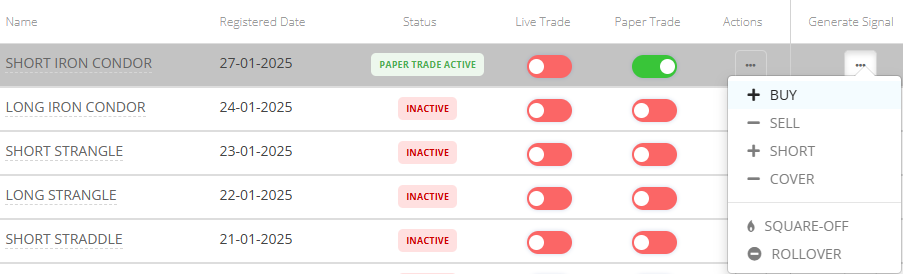

4. Switch on Paper Trade

- Path:

My Group Strategy - Enable Paper Trade mode to test the strategy setup risk-free before going live.

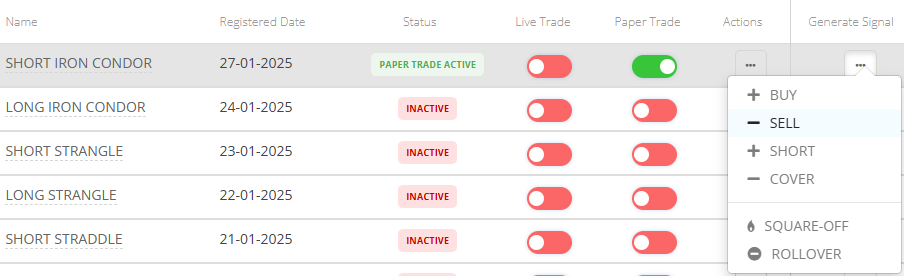

5. Generate SELL Signal

- Path:

My Group Strategy - When your analysis suggests the market will remain range-bound, trigger the SELL signal to open all four legs simultaneously. You’ll collect a net credit.

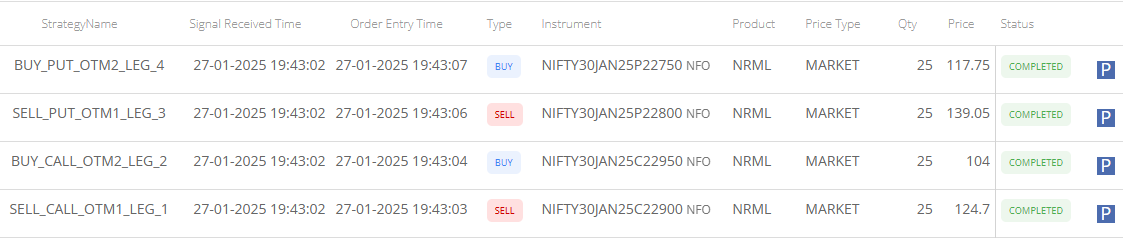

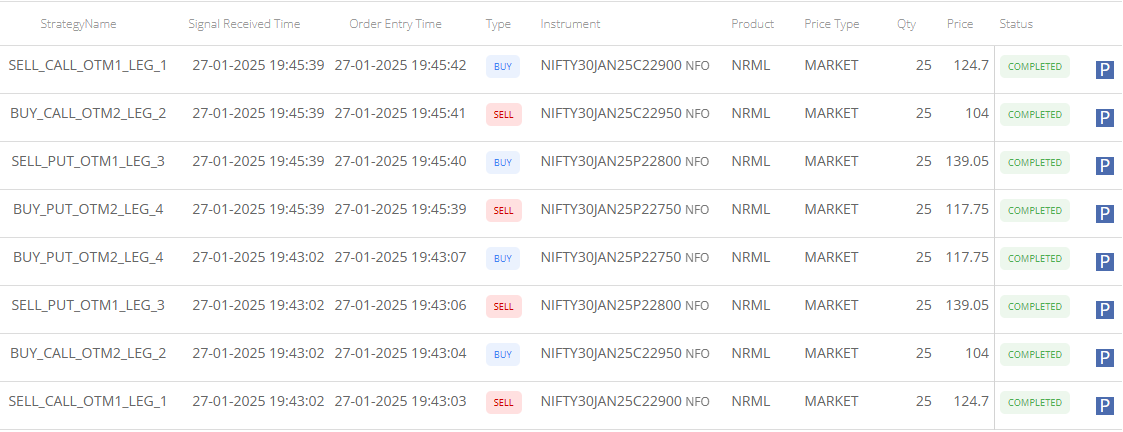

6. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Verify your short call spread and short put spread executed as intended, including net credit details.

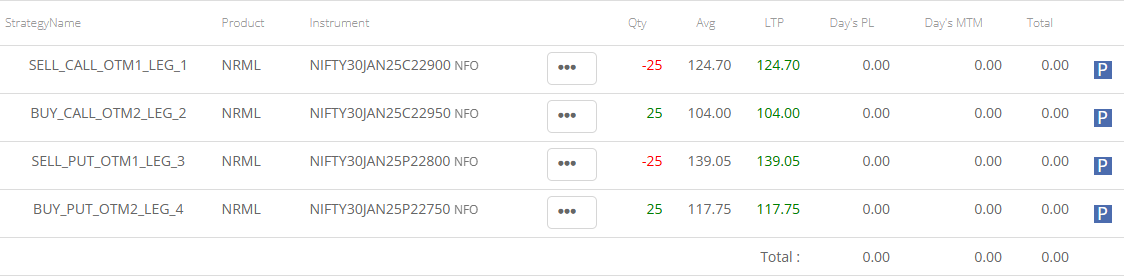

7. Positions after SELL Signal

- Path:

My Group Signals => Positions - Check your open position to confirm your strikes and monitor your potential P/L as time passes.

8. Generate BUY Signal (to Close)

- Path:

My Group Strategy - If you want to close early (e.g., after capturing most of the premium or to avoid large market moves), initiate a BUY signal.

9. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Confirm that all four legs have been bought or closed out, locking in your profit or limiting further losses.

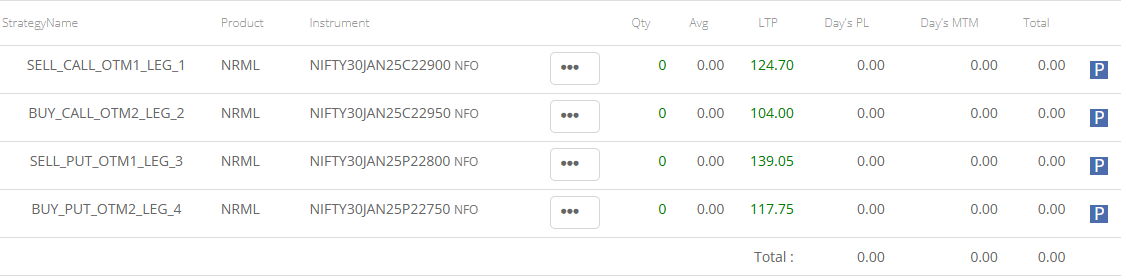

10. Positions after BUY Signal

- Path:

My Group Signals => Positions - Ensure the position is cleared. In live trading, you’ll see real-time MTM and Day’s Realised P&L in this area.

Post-Trade Review

After the options expire or you exit your Iron Condor:

- Did the underlying remain between the short strikes as expected?

- Were your strike distances, deltas, or expiration dates optimal for the current volatility?

- Could you adjust your risk exposure by widening/narrowing the spreads or changing the short legs’ distance?

Use these insights to refine your Short Iron Condor approach and other premium-selling strategies.

Frequently Asked Questions (FAQ)

1. How do I choose the strike prices for a Short Iron Condor?

Traders often select short call and put strikes where they believe the market won’t reach by expiration—this could be based on implied volatility ranges, support/resistance levels, or delta criteria (e.g., 30 delta). The long legs are placed further out-of-the-money to cap risk.

2. What’s the difference between a Short Iron Condor and a Short Strangle?

Both are range-bound premium-selling strategies, but a Short Strangle doesn’t include bought protection. With a Short Iron Condor, you buy additional options on each side to limit potential losses. A Short Strangle carries unlimited risk, while the Iron Condor risk is defined.

3. Is the Short Iron Condor suitable for beginners?

It can be, due to its defined risk and a relatively straightforward profit zone (the short strikes). However, managing four legs is more complex than simpler strategies like a single credit spread. Beginners should consider paper trading or small position sizes at first.

4. What happens if the underlying breaks out of my short strikes?

If the price exceeds your short call or dips below your short put, losses will begin to accumulate on that side. However, the long options placed further OTM cap your maximum potential loss.

5. How does time decay (theta) affect this strategy?

Short Iron Condors primarily benefit from time decay. As expiration nears, the short legs lose value if the underlying stays within the expected range. However, if the underlying makes a big move, that advantage can be overshadowed by the quick rise in the value of your short options.

Final Thoughts

A Short Iron Condor is an excellent range-bound strategy that provides limited risk and a predictable max profit (the net credit) if the underlying stays within a specified zone. By routing your orders through Algomojo, you reduce manual errors and streamline multi-leg execution. Remember, Algomojo does not generate or guarantee profitable trades—it simply executes your external strategy. Thorough backtesting, disciplined risk management, and a clear market outlook are vital for consistent success in options trading.

Happy Trading!