Introduction

We are excited to introduce a new enhancement in Algomojo Strategy Creation – Options Direct Stocks. This feature allows traders to create a watchlist for options stocks with multiple strikes and send signals to execute specific strike prices seamlessly.

Previously, Options Stocks Dynamic Symbols were enabled, and many traders have been using this facility daily to place their orders efficiently. Now, with the addition of Options Stocks Direct Symbols, users gain even greater control over their options trading strategies.

Let’s dive into how this feature works and how it can enhance your trading workflow.

What’s New in This Update?

✅ Options Direct Stocks in Strategy Creation

- Users can now directly add multiple strike prices for options stocks in their strategy watchlist.

- This makes it easier to track and execute trades for specific strikes without needing dynamic symbol selection.

✅ Create Watchlists for Multiple Strikes

- Traders can now build custom watchlists with multiple strike prices for their favorite options stocks.

- This enables quick execution of signals based on pre-selected strikes.

✅ Send Signals for Execution

- Once the strike prices are set in the watchlist, users can send trade signals for executing specific strikes automatically.

- This ensures precision trading while eliminating manual intervention.

Difference Between Dynamic Symbols & Direct Symbols in Options Trading

| Feature | Options Stocks Dynamic Symbols | Options Stocks Direct Symbols |

|---|---|---|

| Selection Type | Automatically selects strikes based on parameters | Manually adds specific strike prices |

| Customization | Limited customization of exact strikes | Full control over strike price selection |

| Execution | Executes based on a dynamic algorithm | Executes signals on predefined strikes |

| Use Case | Ideal for systematic trading based on predefined rules | Best for traders who prefer selecting their strikes manually |

How to Use Options Direct Stocks in Algomojo?

To effectively utilize the Options Direct Stocks feature in Algomojo, follow these step-by-step instructions to create a strategy, manage a watchlist, and execute trades efficiently.

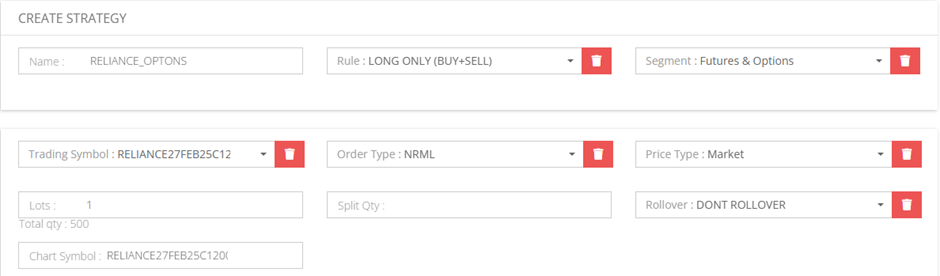

Step 1: Open the Strategy Creation Panel

📍 Path: My Strategy -> New Strategy

1️⃣ Select Segment as “Futures & Options”.

2️⃣ Select Base Options Stock, e.g., RELIANCE27FEB25C1200.

3️⃣ Choose Order Type, Price Type, and Lots as per your strategy.

4️⃣ Assign a Unique Chart Symbol, e.g., RELIANCE27FEB25C1200.

5️⃣ Save the Strategy to proceed.

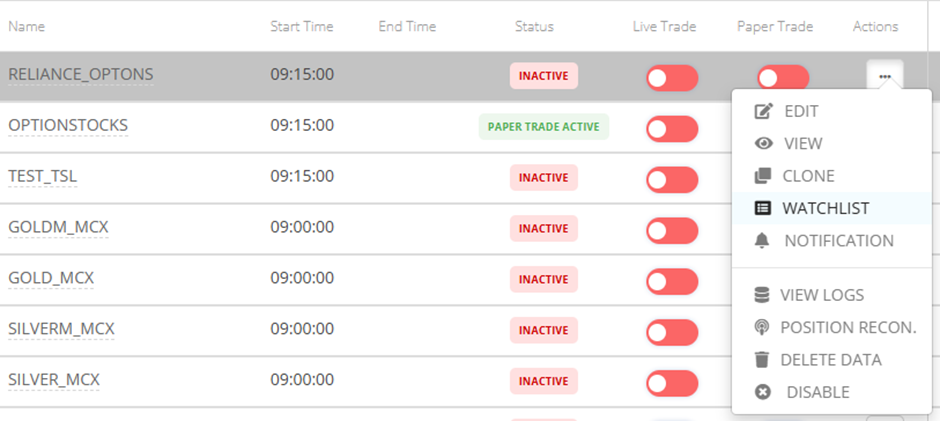

Step 2: Go to Watchlist

📍 Path: My Strategy -> Watchlist

- Navigate to the Watchlist section to manage and monitor your selected options strikes.

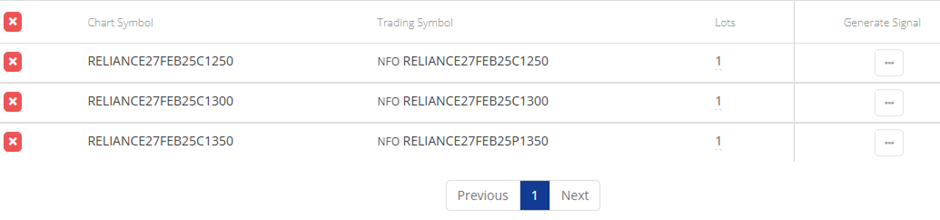

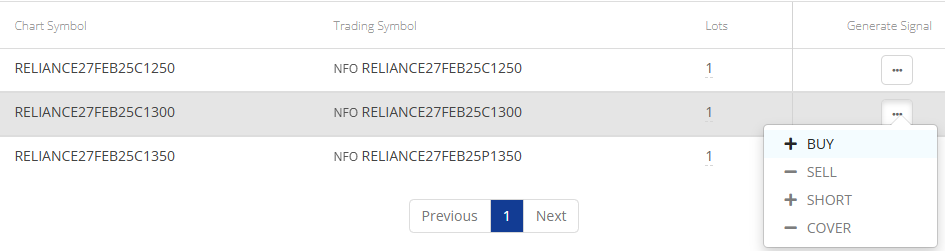

Step 3: Add Different Strike Symbols with Unique Chart Symbols

📍 Path: My Strategy -> Watchlist

- Add multiple strike prices for the base options stock to the watchlist.

- Each strike must have a unique chart symbol for easy identification.

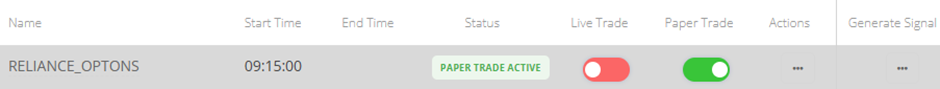

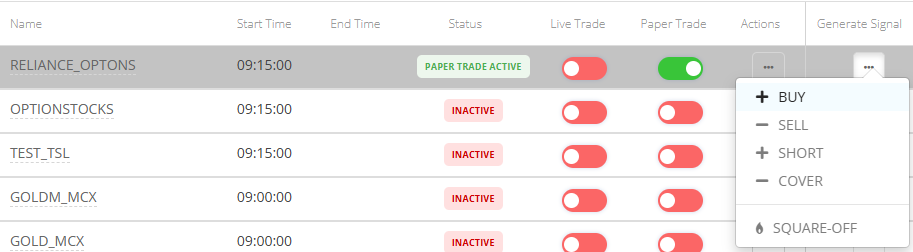

Step 4: Enable Paper Trade

📍 Path: My Strategy

- Enable Paper Trading Mode to test the strategy without executing real trades.

Step 5: Place Manual Buy Signal for Base Strategy Symbol

📍 Path: My Strategy

- Manually trigger a Buy Signal for the Base Options Stock (e.g., RELIANCE27FEB25C1200).

Step 6: Place Manual Buy Signal from Watchlist

📍 Path: My Strategy -> Watchlist

- Select any of the watchlist strikes and place a manual buy signal for execution.

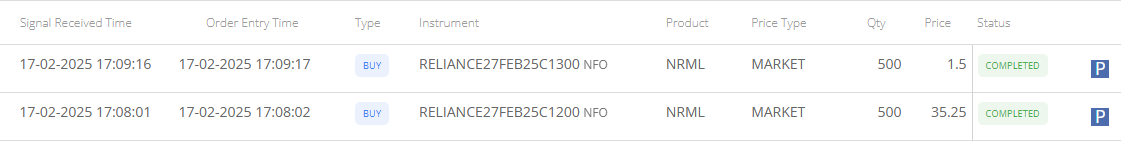

Step 7: Check Paper Trade Execution

📍 Path: My Signals -> Orders

- Review the executed paper trades to analyze order flow and execution.

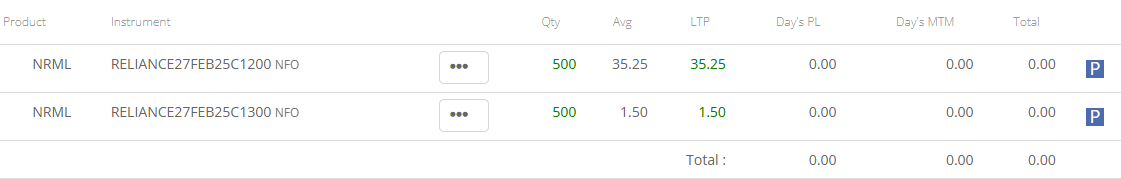

Step 8: Check Open Positions

📍 Path: My Signals -> Positions

- Monitor the active positions to track ongoing trades and performance.

Benefits of Options Stocks Direct Symbols

💡 Greater Flexibility: Manually select strike prices based on your trading strategy.

💡 Faster Execution: No need to manually select strikes at the time of placing orders.

💡 Improved Accuracy: Trade exactly the strikes you want without relying on dynamic selection.

💡 Enhanced Watchlist Management: Keep track of multiple strikes in one place.

Conclusion

By following these steps, you can seamlessly create, manage, and execute options strategies in Algomojo using Options Direct Stocks. This feature enhances control over strike selection, streamlines order execution, and improves trading efficiency.

🔥 Start using this feature today to enhance your options trading efficiency! 🔥

📢 Have questions or feedback? Let us know in the comments! 🚀