What is a Bear Put Spread?

A Bear Put Spread is a moderately bearish options strategy where you buy a put option at a higher strike and sell another put at a lower strike (both with the same expiration). This setup lowers the cost compared to buying a single put outright, while capping potential profits. Your maximum risk is limited to the net premium paid, and profits increase if the underlying price declines—but only up to the lower strike.

Understanding the Bear Put Spread

How It Works

- Buy a Put Option at a higher strike price (the “long put”).

- Sell a Put Option at a lower strike price (the “short put”).

By selling the lower strike put, you reduce the net premium you pay for the spread, which lowers your initial cost. However, this also limits your maximum profit if the underlying asset falls below the lower strike.

Key Benefits

- Lower Cost: Because you’re selling one put option, your net premium outlay is less than buying a single put outright.

- Limited Risk: The maximum loss is capped at the net premium paid for the spread.

- Decent Downside Potential: If the market moves lower (but not drastically lower), you can still earn a solid profit.

Potential Drawbacks

- Capped Profit: Gains are limited to the difference between the two strikes minus the premium paid.

- Time Decay Considerations: Like most options strategies, the passage of time can work against you if the market doesn’t decline quickly enough.

How to Setup in Algomojo?

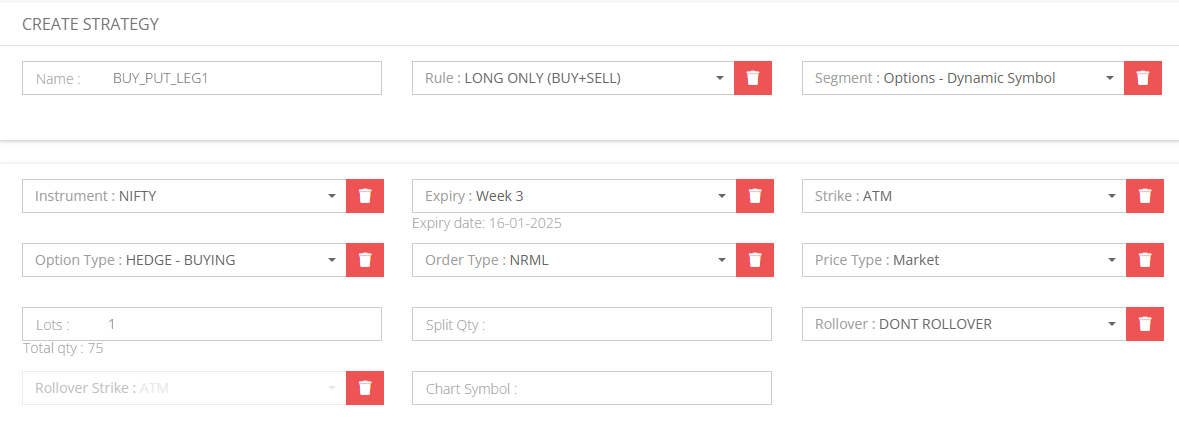

Create Buy ATM Put – Leg 1

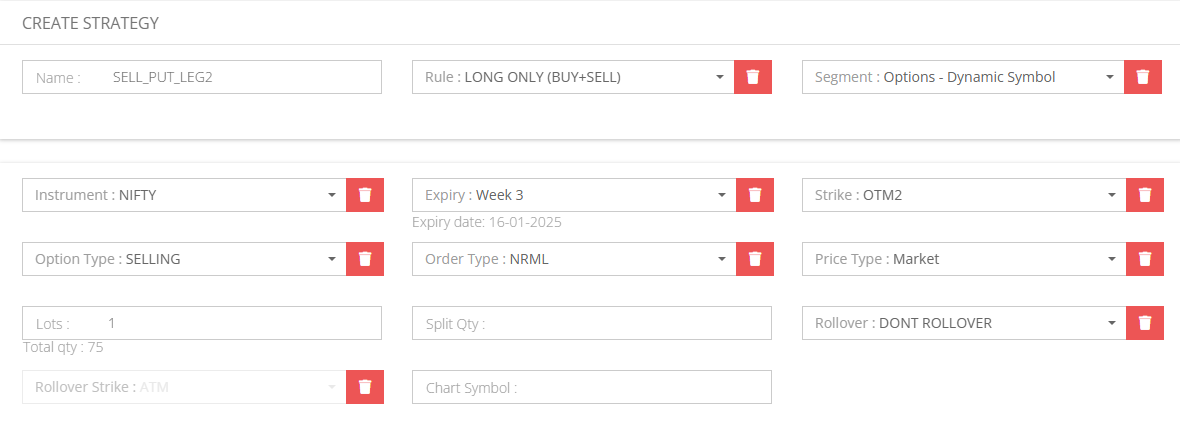

Create Sell OTM2 Put – Leg 2

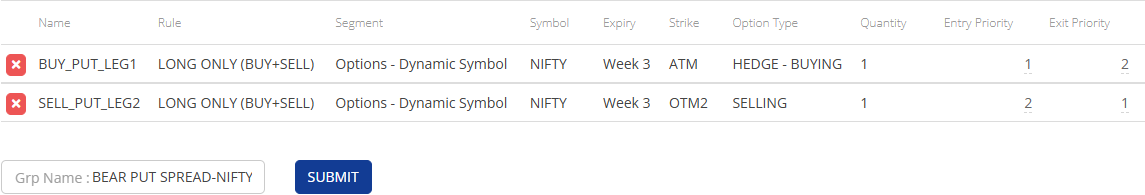

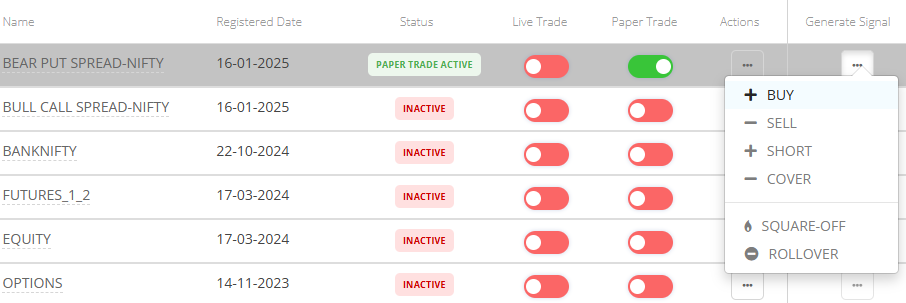

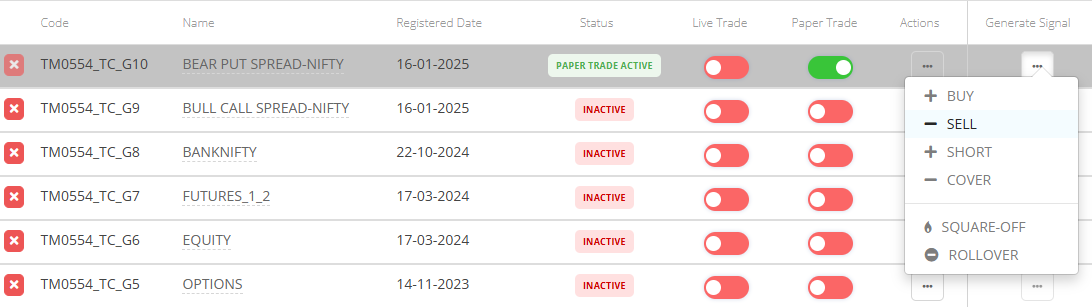

Create a Group Strategy

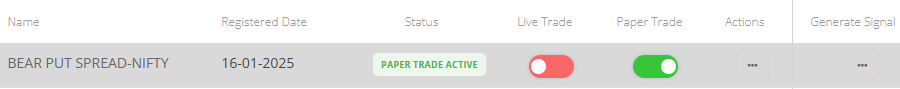

Switch on Paper Trade

Generate BUY Signal

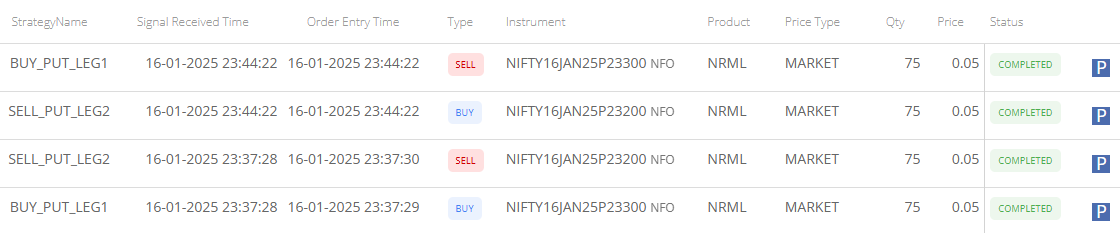

Executed Paper Trade Orders

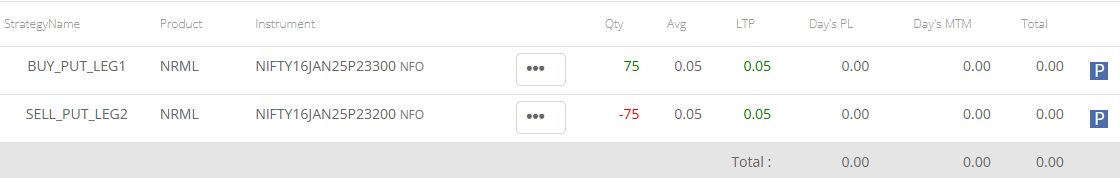

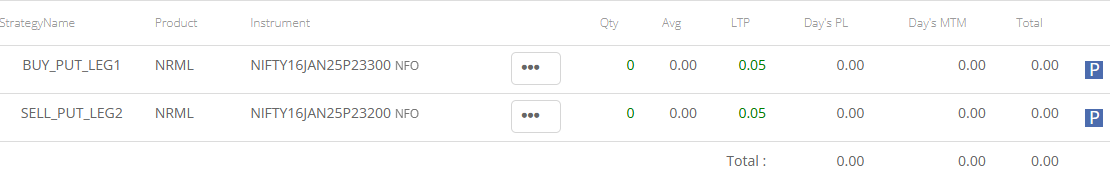

Positions after BUY Signal

Generate SELL Signal

Executed Paper Trade Orders

Positions after SELL Signal

Post-Trade Review

After your spread expires or you exit the position, take a moment to assess the outcome:

- Strategy Performance: Did it meet your expectations?

- Timing Analysis: Were your entry and exit signals well-timed, or was there room for improvement?

- Optimization Possibilities: Could different strikes or a different expiration date have yielded better results?

Use these insights to continuously refine your approach for future trades.

Final Thoughts

A Bear Put Spread offers a cost-effective, risk-defined way to trade in moderately bearish market scenarios. By integrating your signals with Algomojo, you can streamline order execution, reduce manual errors, and focus on refining your strategy. Remember, Algomojo itself does not generate or guarantee profitable signals—it simply executes orders based on your external strategy. Rigorous backtesting, careful risk management, and ongoing learning are crucial for success in any options trading approach.

Happy Trading!