What is a Bear Call Spread?

A Bear Call Spread is a neutral-to-bearish options strategy where you sell a call option at a lower strike and simultaneously buy another call at a higher strike (both with the same expiration). This creates a net credit while capping your potential profit. Your maximum loss is limited by the long call, and you typically profit if the underlying price remains below the short call’s strike at expiration.

Understanding the Bear Call Spread

How It Works

- Sell a Call Option at a lower strike price (the “short call”).

- Buy a Call Option at a higher strike price (the “long call”).

By buying the higher strike call, you limit your potential losses if the market rallies. However, your profit is capped by the net credit received from selling the lower strike call.

Key Benefits

- Net Credit: You receive premium when opening the spread, which can be kept if the underlying stays below the short call strike.

- Risk Defined: The long call caps your risk if the market moves sharply higher.

- Moderate Profit Potential: If the market remains neutral to slightly bearish, you can profit as time decay erodes the short call’s value.

Potential Drawbacks

- Limited Profit: Your maximum profit is the net credit received, no matter how far the underlying price falls.

- Margin Requirements: You may need sufficient margin to cover potential losses if the underlying price rallies strongly.

Step-by-Step Implementation in Algomojo

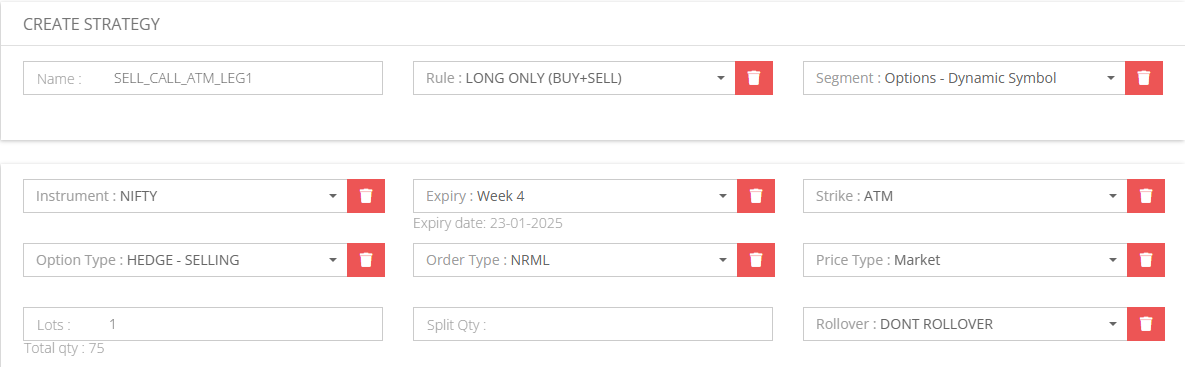

Create Sell ATM Call– Leg 1

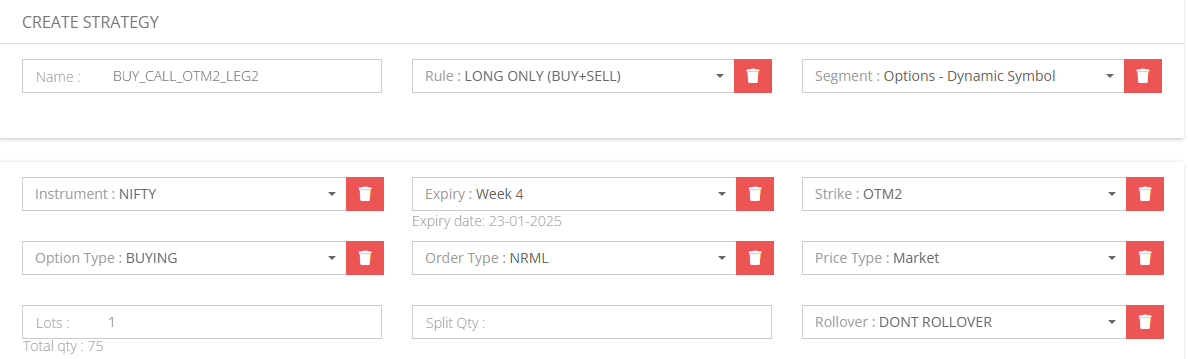

Create Buy OTM2 Call– Leg 2

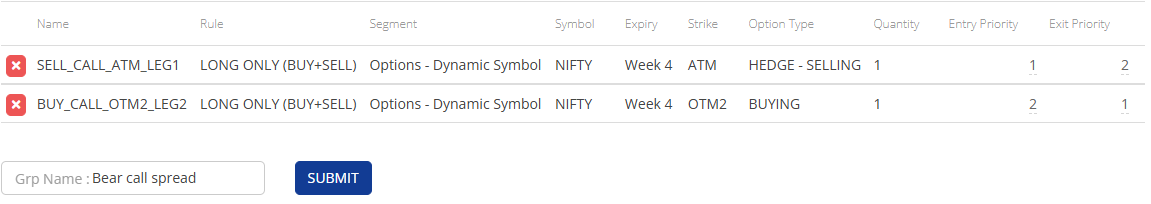

Create a Group Strategy

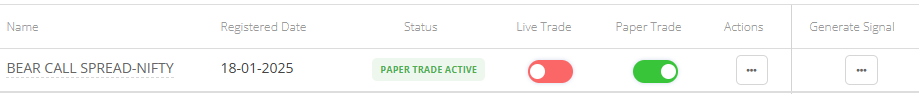

Switch on Paper Trade

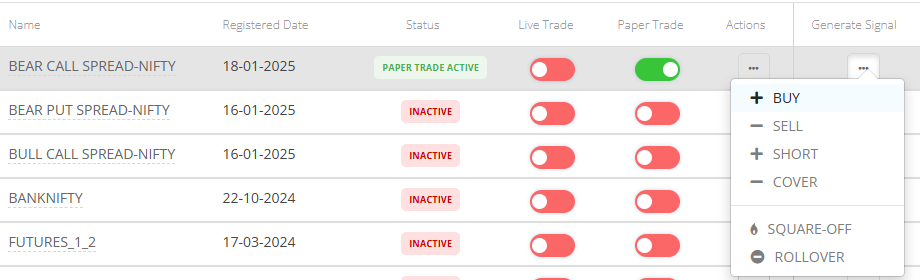

Generate BUY Signal

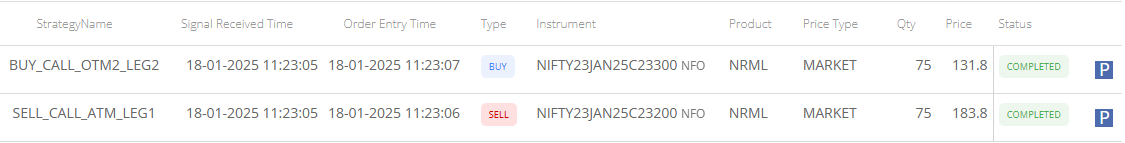

Executed Paper Trade Orders

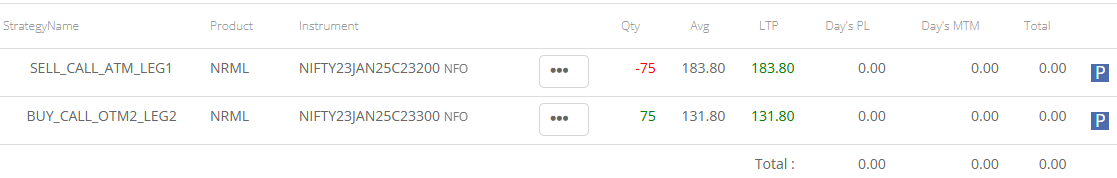

Positions after BUY Signal

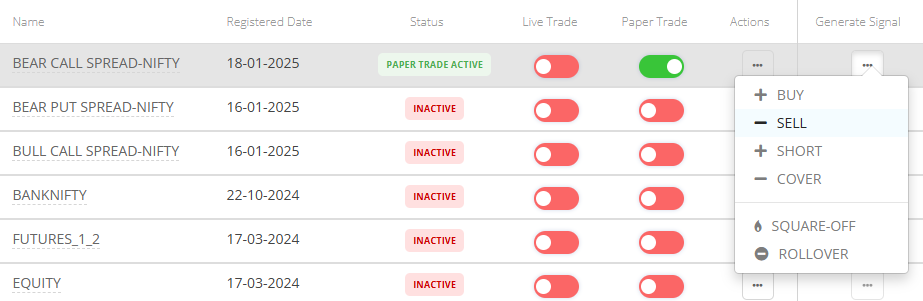

Generate SELL Signal

Executed Paper Trade Orders

Positions after SELL Signal

Note: Real-time MTM and Realised Day’s P&L are shown during Live Market.

Post-Trade Review

Once the spread expires or you exit your position, take time to analyze:

- Did the strategy perform as expected?

- Were your entry/exit signals well-timed?

- Could alternative strikes or expiration dates have improved results?

These insights help fine-tune your approach for future Bear Call Spreads and other strategies.

Final Thoughts

A Bear Call Spread provides a risk-defined way to generate income in a neutral-to-bearish market. By sending your signals to Algomojo, you streamline order execution, reduce manual mistakes, and concentrate on optimizing your trading logic. Keep in mind that Algomojo itself does not generate or guarantee profitable signals—it merely executes your externally generated strategies. Thorough backtesting, careful risk management, and continuous learning remain crucial in any options trading approach.

Happy Trading!