What is a Long Straddle?

A Long Straddle is an options strategy where you buy both a call option and a put option at the same strike price (often at-the-money) and the same expiration date. This strategy benefits from large price movements in either direction; you’re not predicting which way the market will move, just that it will move significantly.

Understanding the Long Straddle

How It Works

- Buy a Call Option at or near the current market price (ATM).

- Buy a Put Option at the same strike and expiration as the call.

Because you own both a call and a put, you can potentially profit from substantial upward or downward movement in the underlying asset’s price. However, if the price remains stagnant, both options could lose value due to time decay.

Key Benefits

- Unlimited Upside: If the underlying surges, the call can generate significant gains.

- Downside Capture: If the underlying plunges, the put becomes valuable.

- Direction-Agnostic: You only need volatility—a big move up or down can lead to profits.

Potential Drawbacks

- High Premium Cost: Buying two options can be expensive; you pay the sum of both premiums upfront.

- Time Decay: If the underlying doesn’t move enough before expiration, the options’ time value erodes, leading to a loss.

- Volatility Risk: If implied volatility drops sharply, option premiums can shrink, hurting your positions even if the underlying moves modestly.

Step-by-Step Implementation in Algomojo

Below is an example workflow to set up a Long Straddle strategy in Paper Trade mode on Algomojo. Adjust the specifics (strike, quantities, etc.) according to your trading plan and broker capabilities.

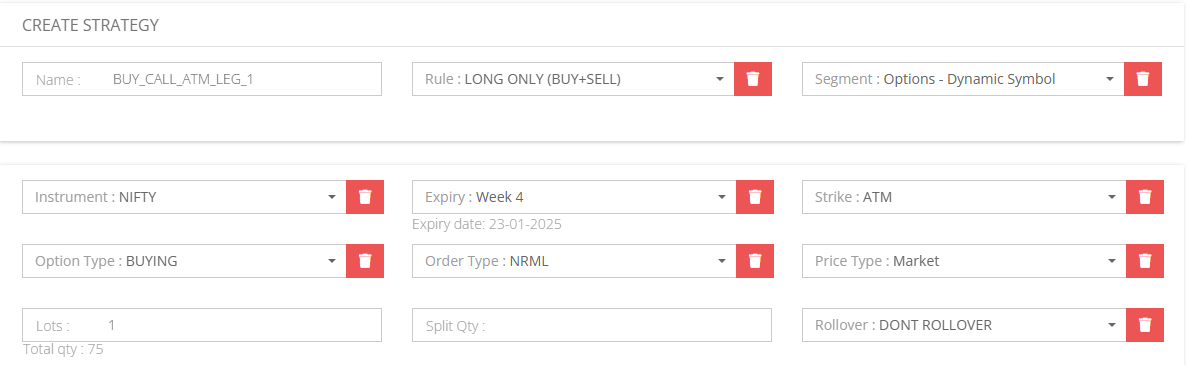

Create Buy ATM Call – Leg 1

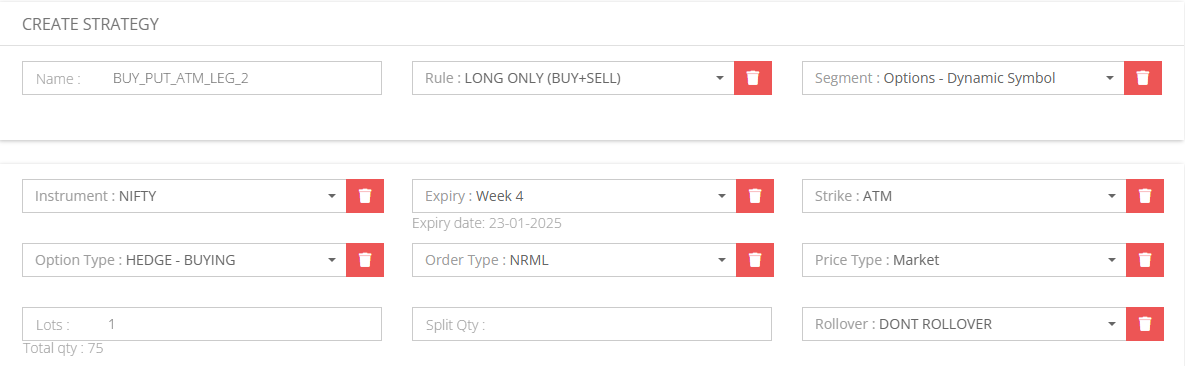

Create Buy ATM Put – Leg 2

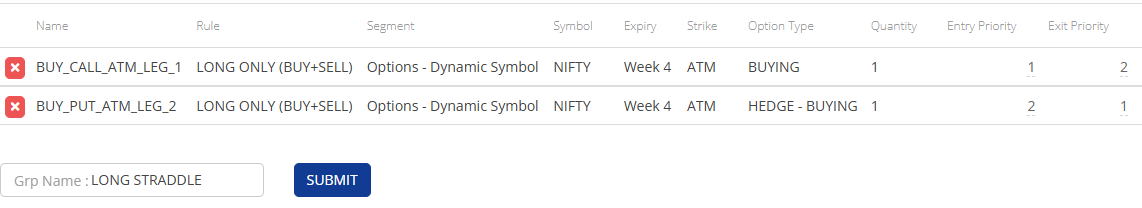

Create a Group Strategy

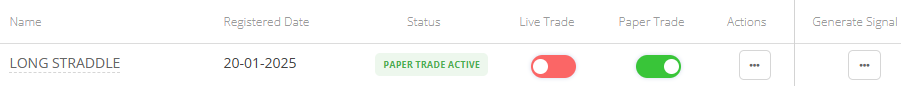

Switch on Paper Trade

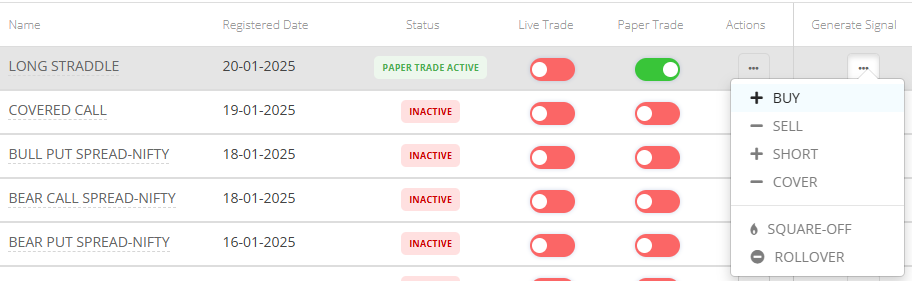

Generate BUY Signal

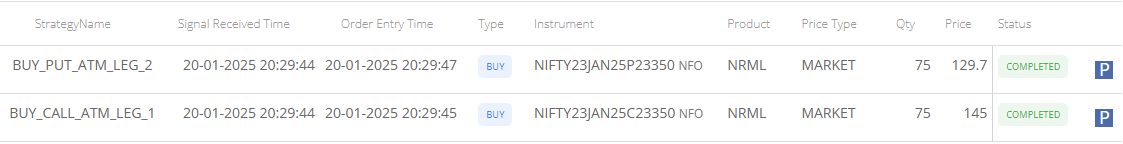

Executed Paper Trade Orders

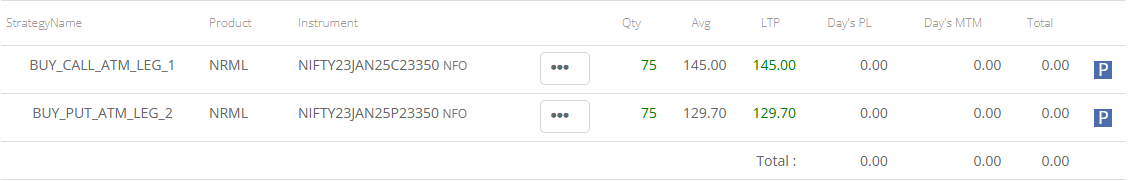

Positions after BUY Signal

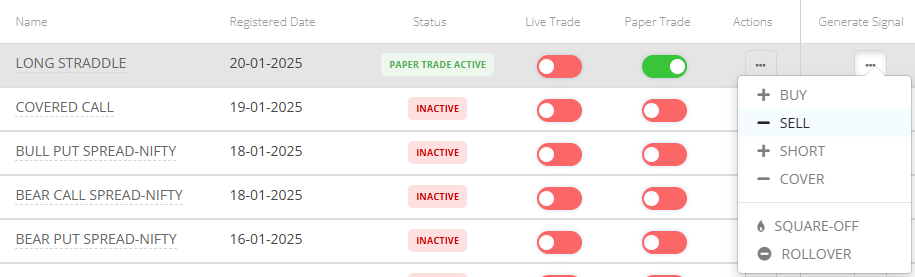

Generate SELL Signal

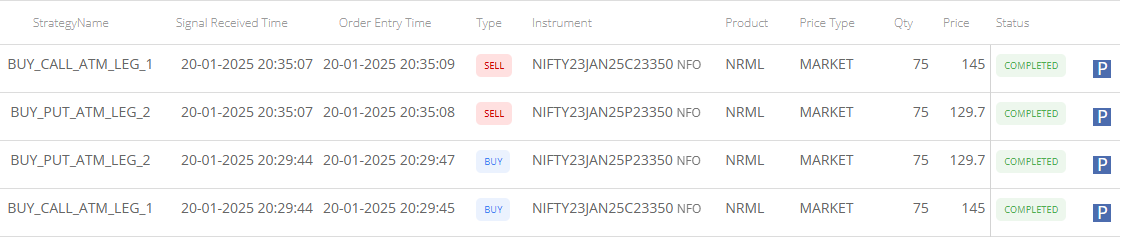

Executed Paper Trade Orders

Positions after SELL Signal

Note: Real-time MTM and Realised Day’s P&L are shown during Live Market.

Post-Trade Review

Once the options expire or you exit the straddle, take time to reflect:

- Did the underlying move enough to justify the premium paid?

- Were your entry and exit triggers effectively timed?

- Could an alternate strike, expiration date, or volatility condition have improved the outcome?

Use these observations to refine your approach for future Long Straddles and other volatility-driven strategies.

Final Thoughts

A Long Straddle can be an effective way to trade uncertain markets where large swings are anticipated but the direction is unclear. By sending your Buy Call and Buy Put signals to Algomojo, you ensure seamless order execution, freeing you to focus on market analysis and risk management. Always remember that Algomojo itself doesn’t generate or guarantee successful signals—it simply executes your chosen strategy. Continual backtesting, prudent risk management, and ongoing learning remain essential for consistent results with any options trading strategy.

Happy Trading!