What is a Bull Put Spread?

A Bull Put Spread is a neutral-to-bullish options strategy where you sell a put option at a higher strike and buy another put option at a lower strike (both with the same expiration). This setup creates a net credit and helps limit your maximum loss if the underlying price declines. Ideally, you profit if the market stays above the short put strike at expiration.

Understanding the Bull Put Spread

How It Works

- Sell a Put Option at a higher strike price (the “short put”).

- Buy a Put Option at a lower strike price (the “long put”).

By buying the lower strike put, you cap potential losses if the underlying price falls significantly. However, your profit is limited to the net credit received from selling the higher strike put.

Key Benefits

- Net Credit: You receive a premium when opening the spread, which you can keep if the underlying stays above the short put strike.

- Defined Risk: The long put limits your losses if the market moves sharply lower.

- Moderate Profit Potential: If the market remains stable or rises, you can profit as the short put’s value decays over time.

Potential Drawbacks

- Limited Profit: Your maximum profit is the net credit, regardless of how high the underlying price goes.

- Margin Requirements: You’ll need enough margin to cover potential losses if the underlying price drops below your long put strike.

Step-by-Step Implementation in Algomojo

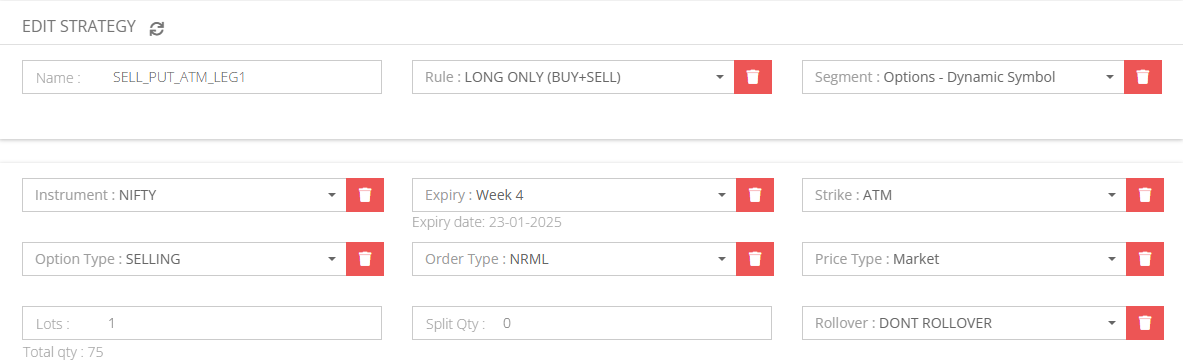

Create Sell ATM Put– Leg 1

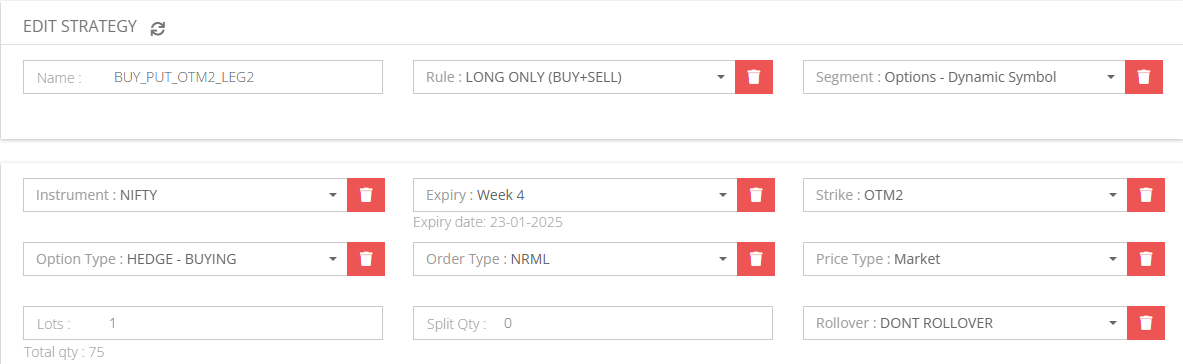

Create Buy OTM2 Put– Leg 2

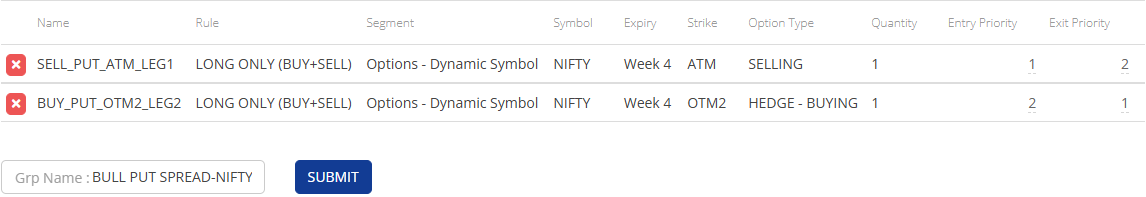

Create a Group Strategy

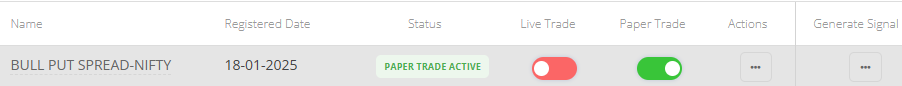

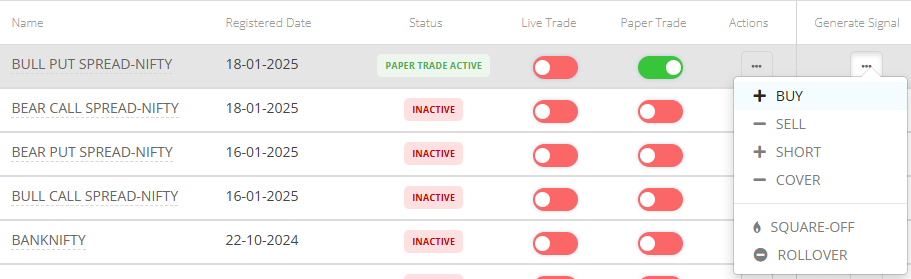

Switch on Paper Trade

Generate BUY Signal

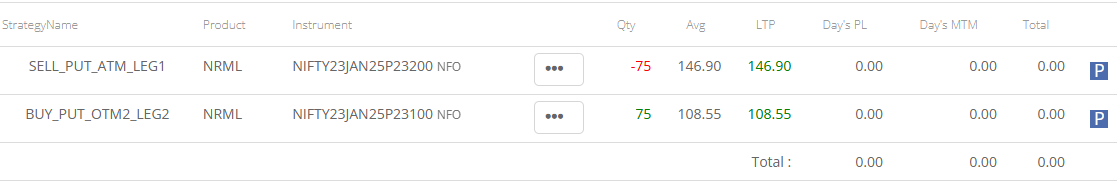

Executed Paper Trade Orders

Positions after BUY Signal

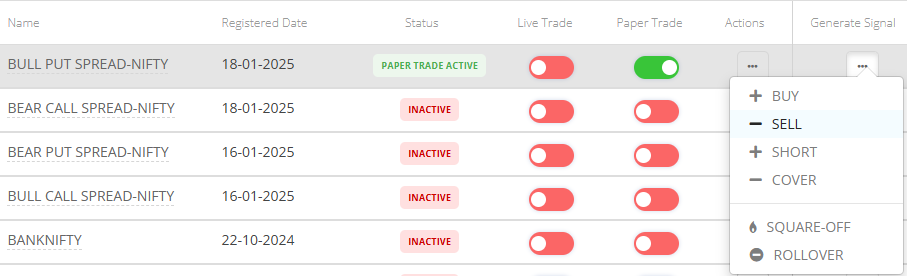

Generate SELL Signal

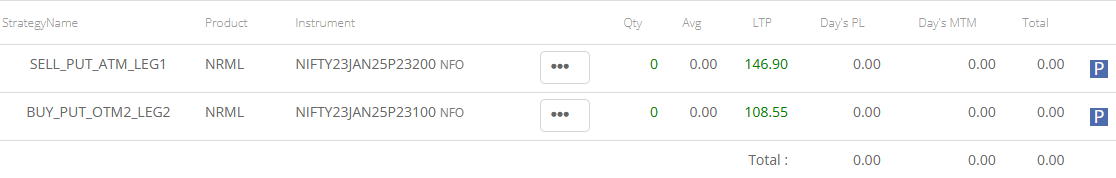

Executed Paper Trade Orders

Positions after SELL Signal

Note: Real-time MTM and Realised Day’s P&L are shown during Live Market.

Post-Trade Review

After the spread expires or you close it:

- Did the strategy perform as expected?

- Was the timing of entry and exit appropriate?

- Could different strikes or expiration dates have improved the outcome?

Collect these insights to refine your approach for future Bull Put Spreads or other trading strategies.

Final Thoughts

A Bull Put Spread offers a defined-risk way to capitalize on a neutral-to-bullish view. By routing your signals through Algomojo, you streamline order execution, reduce manual errors, and focus on fine-tuning your trade logic. Remember that Algomojo doesn’t generate or guarantee profitable signals—its role is to execute your externally crafted strategies. As always, diligent backtesting, solid risk management, and continuous learning are key to thriving in any options trading environment.

Happy Trading!