Algorithmic trading aka automated trading refers to the use of computer algorithms to automatically generate and execute trades in financial markets. These algorithms are designed to analyze market data and identify trading opportunities, and they can be programmed to automatically execute trades based on predefined rules and criteria. Algorithmic trading is used by a wide range of market participants, including individual traders, hedge funds, and investment banks, and it can be applied to various financial instruments such as stocks, bonds, futures, and currencies. Algorithmic trading has become increasingly popular in recent years due to advances in technology and the availability of large amounts of data, as well as the benefits it offers such as faster execution and the ability to trade in large volumes without human intervention.

History of Algorithmic Trading

The use of algorithms in financial markets dates back to the 1970s when simple rules-based systems were used to execute trades on stock exchanges. These early algorithms were relatively basic and were used primarily for executing trades at the best available prices.

In the 1980s, more sophisticated algorithms began to be developed, and the use of computers to analyze market data and identify trading opportunities became more widespread. This period also saw the introduction of electronic trading systems, which allowed traders to enter orders and execute trades electronically rather than through human intermediaries.

The 1990s saw the widespread adoption of electronic trading platforms, and the 2000s saw further advances in technology and data analysis, leading to the development of more complex and sophisticated algorithms. The use of machine learning and artificial intelligence in algorithmic trading also began to emerge during this time.

In recent years, there has been increased regulatory scrutiny of algorithmic trading, with regulators seeking to ensure fairness and transparency in financial markets. Despite this increased scrutiny, algorithmic trading continues to be a popular and influential force in financial markets.

Trading Algorithms in the 1970’s

In the 1970s, the use of simple algorithms in financial markets began to emerge. These early algorithms were used primarily for executing trades at the best available prices, rather than for identifying trading opportunities.

One of the first algorithms used in financial markets was the “program trading” system developed by the New York Stock Exchange (NYSE) in the 1970s. This system allowed traders to enter a list of orders that would be automatically executed when certain market conditions were met. These orders could include a range of different types of trades, such as market orders, limit orders, and stop-loss orders.

Other exchanges also introduced similar systems during this time, and the use of algorithms to execute trades became more widespread. However, these early algorithms were relatively simple and were not capable of analyzing market data or identifying trading opportunities in the same way that more sophisticated algorithms do today.

Trading Algorithms in the 1980’s

In the 1980s, the development of more sophisticated algorithms in financial markets began to accelerate. These algorithms were designed to analyze market data and identify trading opportunities, rather than simply executing trades at the best available prices.

One of the key drivers of this development was the increased use of computers to analyze market data. With the availability of large amounts of data and improved processing power, it became possible to develop algorithms that could analyze market trends and patterns in real-time and identify potential trading opportunities.

Another factor that contributed to the development of more sophisticated algorithms in the 1980s was the increasing use of electronic trading systems. These systems allowed traders to enter orders and execute trades electronically, rather than through human intermediaries. This made it possible for algorithms to be used to execute trades more quickly and efficiently.

The 1980s also saw the emergence of hedge funds, which used algorithms to identify and exploit trading opportunities in financial markets. These funds played a significant role in the development and adoption of algorithmic trading.

Rise of Electronic Trading in 1990’s

The 1990s saw the widespread introduction of electronic trading systems in financial markets. These systems, also known as electronic communication networks (ECNs), allowed traders to enter orders and execute trades electronically, rather than through human intermediaries.

Electronic trading systems revolutionized the way that trades were executed, making it possible for trades to be completed more quickly and efficiently. They also enabled traders to access a wider range of trading opportunities, as they were able to connect to multiple exchanges and other liquidity pools through a single platform.

The first high-frequency trading (HFT) strategies were developed in the late 1990s by a small group of proprietary trading firms. These firms used simple algorithms to execute trades at the best available prices and were primarily focused on providing liquidity to financial markets.

One of the early pioneers of HFT was a firm called Tradebot Systems, which was founded by Dave Cummings in 1999. Tradebot was one of the first firms to use HFT strategies to execute trades on the NYSE, and it played a significant role in the early development of HFT.

Other early HFT firms included Getco and Hudson River Trading, which were both founded in the late 1990s and were among the first to use HFT strategies to trade on electronic exchanges.

Overall, the first HFT trading strategies were developed by a small group of proprietary trading firms that were at the forefront of the development of HFT. These firms played a significant role in the early evolution of HFT and helped to establish it as a major force in financial markets.

Adoption of Electronic Trading platforms in the 2000s

In the 2000s, the adoption of electronic trading platforms in financial markets continued to increase. These platforms, which were built on top of electronic trading systems, provided a wide range of features and tools for traders, including the ability to analyze market data, execute trades, and manage risk.

One of the key drivers of the increased adoption of electronic trading platforms in the 2000s was the increasing availability of data and improved processing power. This made it possible for traders to analyze market data in real time and identify trading opportunities more effectively. It also enabled the development of more sophisticated algorithms that could analyze market data and identify trading opportunities more accurately.

In the 2000s, HFT began to evolve significantly, as advances in technology and data analysis enabled traders to analyze market data more effectively and develop more sophisticated algorithms.

One of the key developments that contributed to the evolution of HFT was the increasing use of machine learning and artificial intelligence. These technologies enabled algorithms to learn from past market trends and patterns, leading to more accurate and efficient trade execution.

High Frequency Trading and Flash Crash in 2010

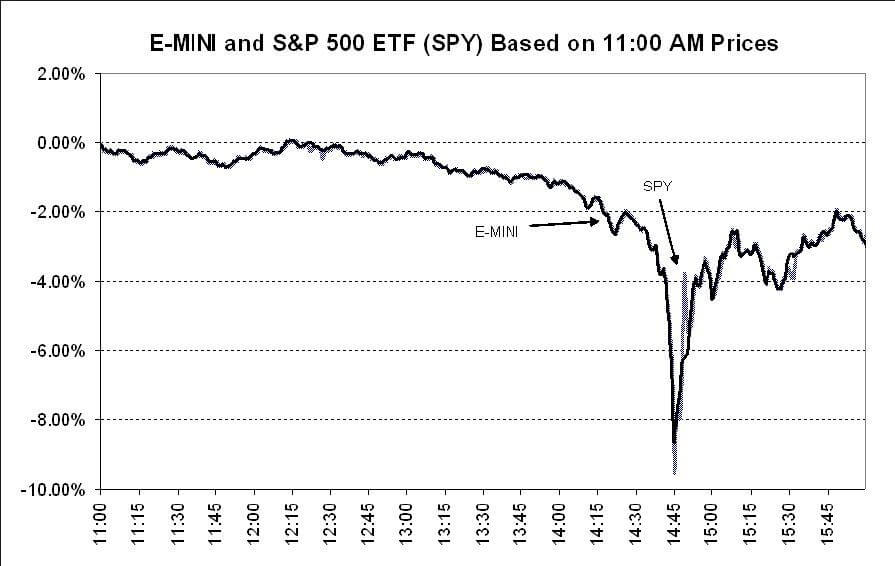

The 2010 flash crash was a sudden and dramatic drop in the value of stocks listed on the NYSE and the NASDAQ. It occurred on May 6, 2010, and saw the Dow Jones Industrial Average (DJIA) fall by nearly 1,000 points, or about 9%, in just a few minutes. The crash was later found to have been caused by a combination of factors, including high-frequency trading (HFT) and the use of complex financial instruments called “derivatives.”

One of the main causes of the flash crash was HFT, which uses advanced computer programs to execute trades at extremely high speeds. These programs can analyze market data and execute trades based on that analysis in a matter of milliseconds or microseconds. However, HFT can also potentially manipulate market prices and liquidity, and some critics argue that it can lead to market instability.

The flash crash also highlighted the risks associated with the use of derivatives, which are financial instruments that derive their value from an underlying asset, such as a stock or a commodity. Derivatives can be used to hedge against risk or to speculate on the movement of an underlying asset, but they can also be complex and difficult to understand. In the case of the flash crash, the use of derivatives may have contributed to the rapid decline in stock prices.

The 2010 flash crash prompted regulators to implement new rules to increase the stability and transparency of financial markets, including rules related to HFT. It also highlighted the importance of having robust risk management systems in place to prevent similar events from occurring in the future.

Rise of API based Automated Trading in India

API-based automated trading, which refers to the use of application programming interfaces (APIs) to connect to a trading platform and execute trades automatically, has become increasingly popular in India in recent years. The rise of API-based automated trading in India has been driven by several factors, including advances in technology, the proliferation of online brokers, and the increasing popularity of algorithmic trading.

One factor that has contributed to the rise of API-based automated trading in India is the increasing availability of trading platforms that offer APIs. Many online brokers and exchanges in India now offer APIs that allow traders and investors to connect their own software or systems to the platform and execute trades automatically. This has made it easier for traders and investors to use automated trading strategies and has contributed to the growth of algorithmic trading in India.

In addition, the proliferation of online brokers in India has made it easier for retail traders to access trading platforms and use automated trading strategies. Many online brokers in India now offer APIs and other tools to support automated trading, and the increasing popularity of online trading platforms has made it easier for retail traders to access the markets and use algorithmic trading strategies.

Advancements in Technology and Data Analysis

Another important development has been the increasing availability of data. With the growth of electronic trading platforms and the proliferation of financial market data, traders now have access to a vast amount of data that can be used to inform their trading decisions. This has made it possible for algorithms to analyze market trends and patterns more effectively, leading to more accurate trade execution.

The use of machine learning and artificial intelligence in algorithmic trading has also played a significant role in the evolution of this field. These technologies enable algorithms to learn from past market trends and patterns, leading to more accurate and efficient trade execution.

Alternate Data

Alternative data refers to data that is not typically used in traditional financial analysis, such as financial statements and market data. It can come from a variety of sources, including social media, satellite imagery, and point-of-sale data, and can be used to gain insights into a company’s performance or the broader economy.

The rise of alternative data has been driven by advances in technology, which have made it easier to collect, process, and analyze large amounts of data from a variety of sources. In addition, the proliferation of the internet and social media has created new sources of data that can provide insights into consumer behavior and sentiment.

Alternative data has become increasingly popular in the financial industry, as it can provide a more complete and nuanced picture of a company or the economy. For example, satellite imagery can be used to track the activity of a company’s facilities or the movement of goods, while social media data can provide insights into consumer sentiment and preferences.

Rise of News-Based Trading

News-based trading refers to the use of news and other external events to inform trading decisions. This type of trading has become increasingly popular in recent years, as traders seek to take advantage of market reactions to news and other events.

One of the key factors driving the rise of news-based trading is the increasing availability of real-time news and data. With the proliferation of online news sources and the development of automated news feeds, traders have access to a vast amount of information that can be used to inform their trading decisions. This has made it easier for traders to stay up-to-date on market-moving events and to react quickly to changing market conditions.

Another factor contributing to the rise of news-based trading is the increasing use of algorithms and other automated trading tools. These tools enable traders to analyze news and other data in real-time and to execute trades quickly and efficiently. This has made it possible for traders to take advantage of market reactions to news and other events more effectively.

An example of a news-based automated trading strategy might involve the use of an algorithm to analyze real-time news feeds and other data sources for market-moving events. When an event is identified, the algorithm could analyze the potential impact of the event on financial markets and identify potential trading opportunities.

For example, if a news story is released indicating that a major company is releasing better-than-expected earnings, an automated trading algorithm might analyze the potential impact of this news on the company’s stock price and other related financial instruments. If the algorithm determines that the news is likely to have a positive impact on the stock price, it could execute a buy order for the stock.

Alternatively, if the algorithm determines that the news is likely to have a negative impact on the stock price, it could execute a sell order. In this way, the algorithm can take advantage of market reactions to news and other events in a rapid and efficient manner.

Increased Regulatory Scrutiny

In recent years, there has been increased regulatory scrutiny of algorithmic trading, as regulators seek to ensure fairness and transparency in financial markets. This increased scrutiny has been driven by concerns about the potential for algorithmic trading to create imbalances in the market and to manipulate prices.

Regulators around the world have introduced a range of measures to address these concerns, including the introduction of new rules and regulations specifically designed to govern algorithmic trading activities. These measures have been designed to ensure that algorithmic traders operate in a transparent and fair manner, and to prevent them from engaging in activities that could harm the integrity of financial markets.

Future Outlook for Algorithmic Trading

It is difficult to predict exactly what the future holds for algorithmic trading, as it is a field that is constantly evolving and influenced by a range of factors. However, it is likely that algorithmic trading will continue to play a significant role in financial markets in the future.

One trend that is likely to continue is the increasing use of machine learning and artificial intelligence in algorithmic trading. These technologies enable algorithms to learn from past market trends and patterns, leading to more accurate and efficient trade execution. As the availability of data and processing power continues to increase, it is likely that the use of machine learning and artificial intelligence in algorithmic trading will become more widespread.

Another trend that is likely to continue is the increasing importance of data in algorithmic trading. As more data becomes available, traders will be able to analyze market trends and patterns more effectively and develop more sophisticated algorithms for trade execution. This could lead to further advances in algorithmic trading and the development of new trading strategies and techniques.

It is also likely that there will be continued regulatory scrutiny of algorithmic trading, as regulators seek to ensure fairness and transparency in financial markets. This may result in the introduction of new rules and regulations specifically designed to govern algorithmic trading activities.

Overall, the future outlook for algorithmic trading is positive, with the field likely to continue to evolve and play a significant role in financial markets.