Introduction

The Put Calendar Spread, also known as a Time Spread, is a strategic options trading approach designed to profit from time decay (Theta) and changes in implied volatility (IV). This strategy involves buying and selling put options with the same strike price but different expiration dates to take advantage of time decay and potential volatility expansion.

The Put Calendar Spread is ideal for traders who expect the underlying stock to stay near the strike price in the short term but anticipate a potential increase in volatility or price movement near the longer expiration date.

In this blog, we will explore the Put Calendar Spread strategy, how it works, its benefits and risks, and how to execute it efficiently using Algomojo.

What is a Put Calendar Spread?

A Put Calendar Spread consists of:

✅ Selling a short-term put option (near-term expiration)

✅ Buying a long-term put option (longer expiration)

Both options have the same strike price but different expiration dates.

This setup allows traders to profit from time decay in the short option while maintaining a long exposure for potential price movement in the longer term.

Structure of a Put Calendar Spread

The strategy involves two options contracts:

- Sell 1 Near-Term Put Option (Short Expiry)

- Buy 1 Long-Term Put Option (Long Expiry)

This setup creates a net debit position, meaning the total cost is the difference between the two option premiums.

Example of a Put Calendar Spread

Assume Stock XYZ is trading at ₹100, and you execute the following trades:

- Sell 1 short-term put option at ₹100 (Expires in 1 month)

- Buy 1 long-term put option at ₹100 (Expires in 3 months)

Profit Scenario

✅ If XYZ stays close to ₹100 at short expiry, the short put loses value due to time decay, resulting in profit.

✅ If XYZ declines before long expiry, the long put gains value, providing additional profit.

Key Takeaways

✅ Profits from Time Decay (Theta): The short-term put loses value faster than the long-term put.

✅ Limited Risk: Maximum loss is the net debit paid for the strategy.

✅ Potential for Large Gains: If volatility increases near long expiry, the long put benefits.

✅ Low Capital Requirement: Requires a lower margin compared to directional strategies.

Payoff Structure of a Put Calendar Spread

| Scenario | Impact |

|---|---|

| Price stays near the strike at short expiry | ✅ Maximum Profit |

| Price moves far from the strike | ❌ Loss due to short put exposure |

| Volatility increases | ✅ Gains in long put value |

| Volatility decreases | ❌ Loss as long put loses value |

Advantages of a Put Calendar Spread

📉 Profits from Time Decay: The short put loses value faster than the long put.

📊 Works in Low Volatility Markets: Ideal when the underlying is range-bound.

🛑 Limited Risk: Loss is capped at the net premium paid.

📈 Volatility Advantage: If IV increases, the long put gains value.

Risks and Considerations

❌ Directional Risk: If the stock moves too far, the short put may cause losses.

❌ IV Impact: A drop in volatility reduces the value of the long put.

❌ Rolling May Be Required: Traders may need to adjust the short put before expiration.

Step-by-Step Implementation in Algomojo

With Algomojo, traders can seamlessly execute Put Calendar Spreads using automated order placement and execution.

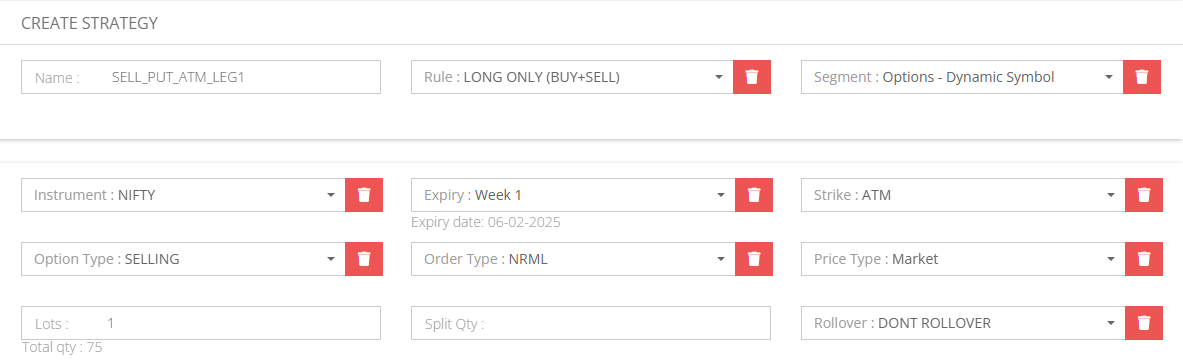

1. Create a Sell ATM Put for Short Expiry (Leg 1)

📍 Path: My Strategy → New Strategy

- Choose a near-term expiration date.

- Select the ATM (At-the-Money) strike price.

- Ensure the correct lot size and margin before execution.

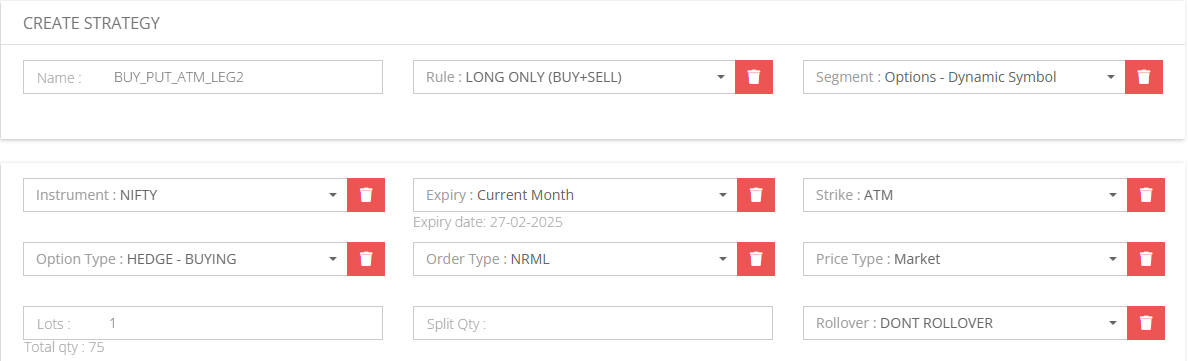

2. Create a Buy ATM Put for Long Expiry (Leg 2)

📍 Path: My Strategy → New Strategy

- Choose a longer expiration date.

- Select the same ATM strike price.

- Ensure the correct lot size and margin before execution.

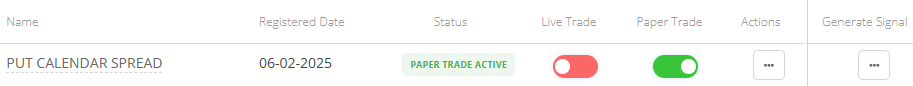

3. Group the Strategy

📍 Path: My Group Strategy → New Group Strategy

- Combine both legs into a single Put Calendar Spread.

- Name the strategy for easy identification.

4. Enable Paper Trade Mode

📍 Path: My Group Strategy

- Test the strategy before executing in a live market.

- Validate the position behavior with simulated market movement.

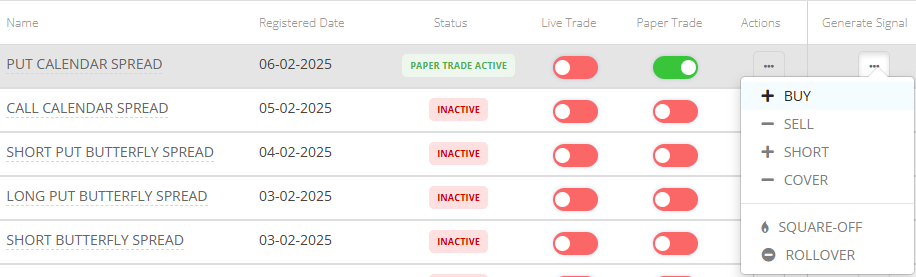

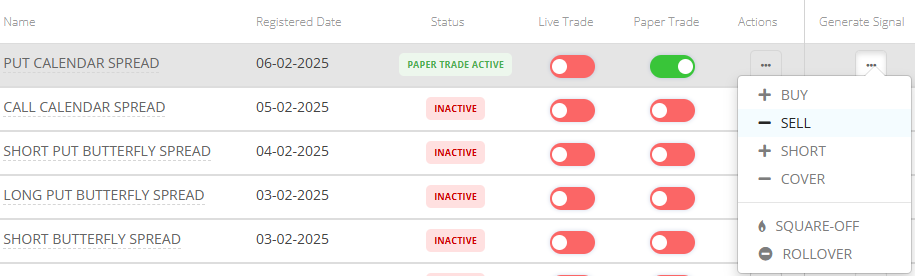

5. Generate BUY Signal

📍 Path: My Group Strategy

- Click BUY to place both orders simultaneously.

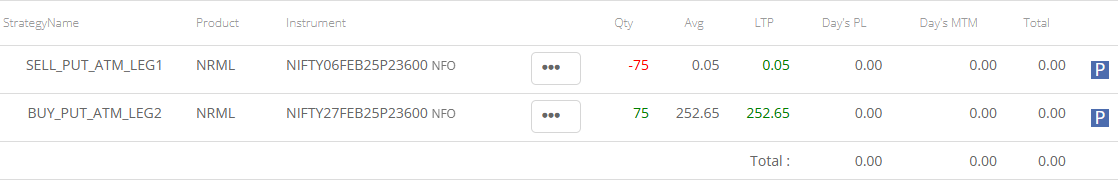

6. Executed Paper Trade Orders

📍 Path: My Group Signals → Orders

- Verify that both legs are successfully placed in the Order Book.

- Ensure all contracts have been filled at your intended strike and expiration.

7. Monitor Open Positions

📍 Path: My Group Signals → Positions

- Track price movement and implied volatility (IV) changes.

- Monitor the effect of time decay (Theta) on the short put.

8. Generate a SELL Signal to Exit the Trade

📍 Path: My Group Strategy

- If the stock stays near the strike price, exit the trade for profit.

- If IV increases, consider holding the long put for further gains.

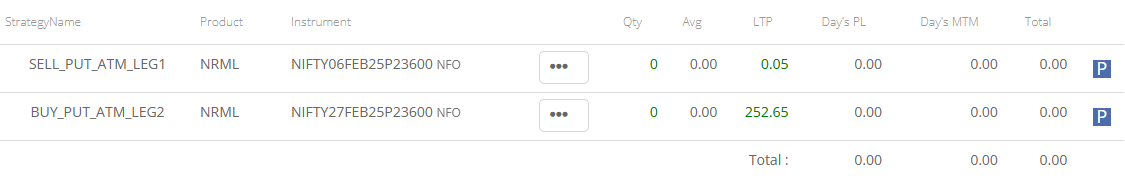

9. Confirm Closing Orders

📍 Path: My Group Signals → Orders

- Ensure both legs are exited at the intended price levels.

- Validate the final PnL impact before settlement.

10. Review Trade Performance

📍 Path: My Group Signals → Positions

- Analyze profit/loss metrics and strategy efficiency.

- Check how IV and time decay affected the trade outcome.

- Optimize future Put Calendar Spread strategies based on insights.

Frequently Asked Questions (FAQ)

1️⃣ How is a Put Calendar Spread different from a Call Calendar Spread?

📌 Put Calendar Spread: Used when traders are neutral to bearish.

📌 Call Calendar Spread: Used when traders are neutral to bullish.

2️⃣ What happens if the stock moves far from the strike price?

📌 If XYZ moves significantly away from ₹100, the short put may cause losses.

📌 Traders may need to roll the short put forward.

3️⃣ Can I use an OTM Put for a Calendar Spread?

📌 Yes, you can create a bearish calendar spread using an OTM Put.

📌 However, ATM options generally perform better for neutral strategies.

4️⃣ Does this strategy work in high volatility markets?

📌 Not ideally. Put Calendar Spreads work best in low-volatility environments.

📌 However, an increase in IV helps boost profitability.

5️⃣ Can I execute this strategy manually?

📌 Yes, but Algomojo automates execution, reducing manual errors.

Final Thoughts

The Put Calendar Spread is a powerful strategy for traders who expect low short-term volatility but want to take advantage of time decay and potential IV expansion.

By using Algomojo, traders can efficiently execute, monitor, and refine this strategy with automated multi-leg execution and real-time tracking.

💡 Have you tried a Put Calendar Spread before? Share your experience in the comments! 🚀🔥