A Long Synthetic Future is an options strategy that replicates owning a futures contract using call and put options. By simultaneously buying a call and selling a put at the same strike (and same expiration), you can mimic the payoff of being “long” the underlying. This approach often requires lower margin than buying the actual futures contract and can provide unique flexibility for traders seeking leveraged exposure.

What is a Long Synthetic Future?

A synthetic future mirrors the price movement of a futures contract without directly trading the future itself. Specifically, a long synthetic is built by:

- Buying a Call Option at a particular strike price.

- Selling a Put Option at the same strike price (and expiration date).

If done at or near-the-money, this combination behaves similarly to a long futures position: for every point the underlying rises above the strike, the strategy gains; if the underlying falls below the strike, it loses.

Key Takeaway

- Long Synthetic = Long Call + Short Put at the same strike and expiration.

- Essentially, you’re replicating the delta (price sensitivity) of the underlying, minus certain capital or margin differences compared to a standard futures contract.

Understanding the Long Synthetic Future

How It Works

- Buy Call (long call leg):

- Grants you the right (but not the obligation) to buy the underlying at the strike price.

- If the market rises, this call gains value.

- Sell Put (short put leg):

- Obligates you to buy the underlying at the strike if assigned.

- If the market falls, this put can create a loss.

When you combine both at the same strike and expiration, the net effect is that you pay or receive a certain premium (depending on whether the call is more or less expensive than the put). The resulting position acts much like holding the underlying itself.

Key Benefits

- Reduced Capital Requirement: Often, the margin for a long synthetic future can be lower than outright buying the stock/index or trading a futures contract, depending on your broker’s rules.

- Flexibility: You can pick the strike and expiration that best matches your market outlook.

- No Time Decay on the Net Position: At-the-money call and put typically balance out in time decay if structured near 50 delta each—though changes in implied volatility can still affect the position.

Potential Drawbacks

- Assignment Risk (Short Put Leg): If the underlying falls below the put strike, you could be assigned shares (or the underlying) before expiration in American-style options.

- Margin Requirements: You still need sufficient margin to cover potential losses on the short put.

- Vega and Implied Volatility: If implied volatility drops after you enter the position, the long call may lose value faster than the short put gains (or vice versa). The net effect can deviate from a perfect “future” replication in the short term.

Step-by-Step Implementation (Example in Algomojo)

Below is a sample workflow for setting up a Long Synthetic Future in Paper Trade mode. Adapt your specific strikes and expirations based on your market outlook and the liquidity of the options you’re trading.

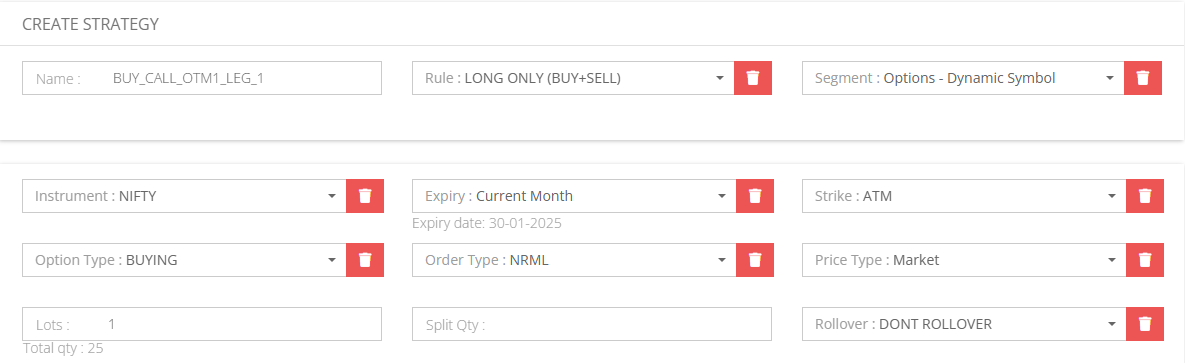

- Create Buy Call (long call leg)

- Path:

My Strategy => New Strategy - Select an expiration date and strike price at or near the current underlying price if you want to replicate a near-1.0 delta (like a futures contract).

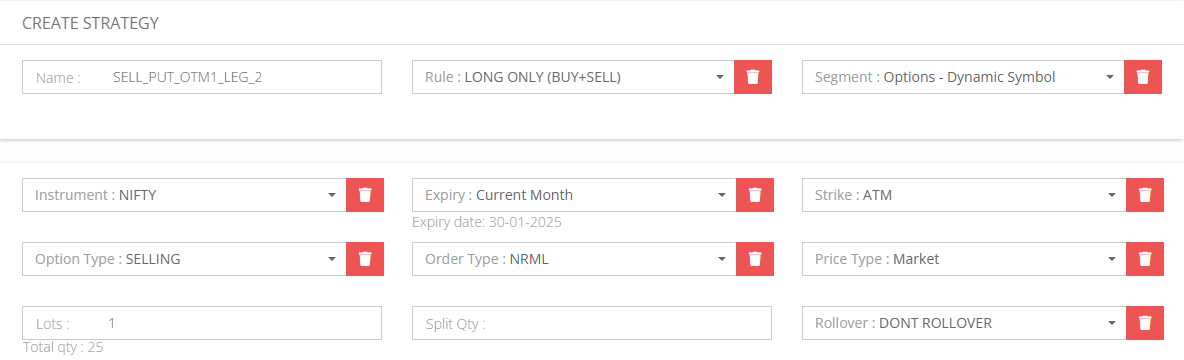

2. Create Sell Put (short put leg)

- Path:

My Strategy => New Strategy - Use the same expiration date and strike as the long call.

- This short put offsets the call’s premium and helps mirror the underlying’s movement.

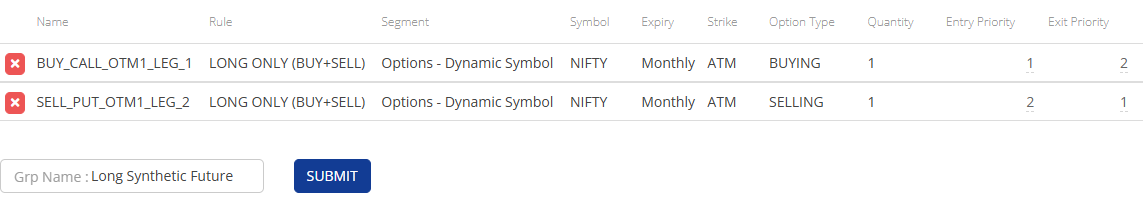

3. Group Your Strategy

- Path:

My Group Strategy => New Group Strategy - Combine the long call and short put into a single group (Long Synthetic Future).

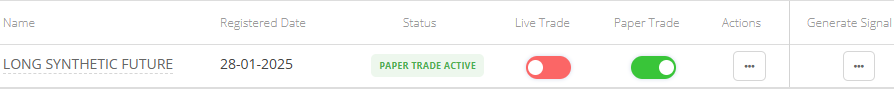

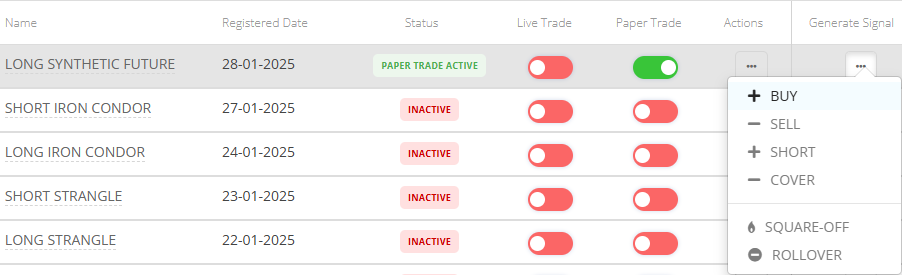

4. Switch on Paper Trade

- Path:

My Group Strategy - Enable Paper Trade mode to verify your strategy setup and understand the P/L behavior before going live.

5. Generate BUY Signal

- Path:

My Group Strategy - If you believe the underlying will rise (or you simply want to replicate ownership), trigger the BUY signal to open both legs simultaneously.

6. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Confirm the trades filled at your intended strike and expiration. Check net premium or debit to ensure the position was established correctly.

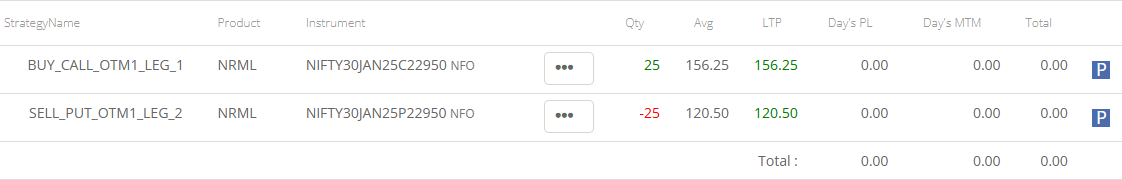

7. Positions after BUY Signal

- Path:

My Group Signals => Positions - Monitor the open synthetic position. Track the underlying’s price movement relative to your strike.

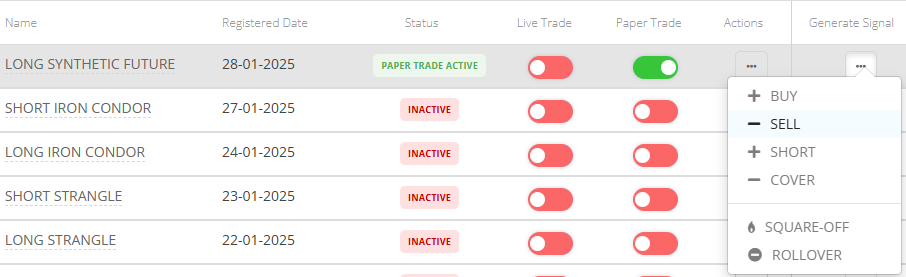

8. Generate SELL Signal (to Close)

- Path:

My Group Strategy - If you decide to exit (e.g., you’ve reached a profit target or market view changes), issue a SELL signal to close both the call and the put.

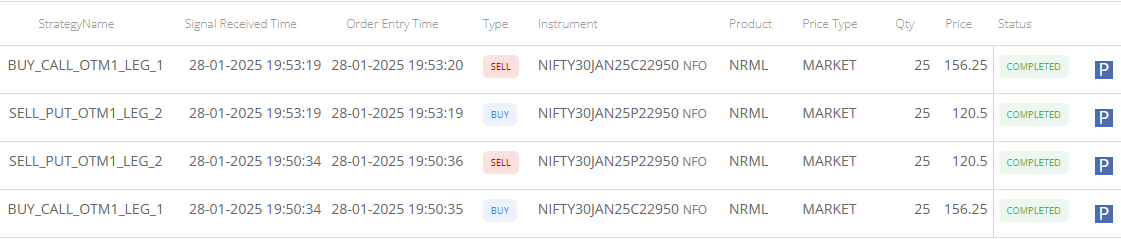

9. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Confirm that each leg is offset (buy back the short put, sell the long call).

10. Positions after SELL Signal

- Path:

My Group Signals => Positions

- Verify you have no remaining open legs. If you’re trading live, keep an eye on real-time MTM and Realised P&L for final outcomes.

Post-Trade Review

When the position expires or you close out your synthetic future, analyze:

- Did the underlying move as expected?

- How did implied volatility changes affect the combined position?

- Were margin requirements and potential assignment risk managed properly?

Use these insights to refine how you structure future synthetic positions, including strike selection, time frames, and how you handle potential early assignment on the short put.

Frequently Asked Questions (FAQ)

- How is a Long Synthetic Future different from buying a futures contract outright?

- A synthetic future uses options to replicate the payoff of a long futures position. It can require less margin (in some cases) and doesn’t involve rolling futures contracts. However, you must manage the short put’s assignment risk.

- What if the short put gets assigned early?

- If you’re assigned, you’ll effectively own the underlying at the strike price. The long call remains in place. You can either hold the shares or close the call to unwind the overall position.

- Does implied volatility matter?

- Yes. While a near-the-money call and put can offset some time decay, changes in implied volatility can still cause temporary deviations from the exact “futures” payoff, especially if IV changes are not symmetric for calls and puts.

- Is a Long Synthetic Future always cheaper than buying the underlying?

- Not necessarily. The net cost or credit of the options depends on implied volatility, interest rates, dividends (for stocks), and other factors. Sometimes you might pay a slight net debit; other times you might collect a small net credit.

- When should I consider a Long Synthetic Future instead of simply buying shares or the underlying?

- If you’re comfortable with the potential assignment risk, and your broker’s margin rules are favorable, a synthetic future can offer a leveraged way to replicate stock ownership. Some traders also prefer it for short-term strategies where futures may not be available or have less favorable margin treatment.

- What’s the difference between a Long Synthetic Future and a Call/Put Spread?

- A call/put spread defines a limited profit and limited risk scenario. A synthetic future aims to replicate the unlimited upside and downside of holding the underlying. Spreads cap gains and losses, while a synthetic future does not (apart from the max loss if the underlying goes to zero, in the case of a stock).

Final Thoughts

A Long Synthetic Future offers a versatile way to replicate ownership of an underlying instrument using options. It can be more capital-efficient than buying outright—depending on margin requirements—and provides an alternative to trading actual futures contracts. However, you must manage assignment risk on the short put and understand implied volatility dynamics to maintain an effective position. By integrating the strategy with a platform like Algomojo, you can streamline multi-leg execution, track real-time P&L, and refine your approach through post-trade reviews. As always, Algomojo merely executes your external strategy; it’s up to you to apply sound risk management, market analysis, and ongoing learning for continued success.

Happy Trading!