What is a Long Strangle?

A Long Strangle is an options strategy where you buy an out-of-the-money (OTM) call and buy an out-of-the-money (OTM) put with the same expiration date but different strike prices. This strategy profits from significant price movement in either direction, without requiring that the underlying be at-the-money at trade initiation.

Understanding the Long Strangle

How It Works

- Buy an OTM Call Option: Typically above the current market price.

- Buy an OTM Put Option: Typically below the current market price.

By owning both an OTM call and an OTM put, you can capitalize on big market swings—up or down—beyond the chosen strikes. Similar to a Long Straddle, your exact direction view is neutral, but you anticipate volatility or a large price move.

Key Benefits

- Lower Initial Cost Than a Straddle: Because both options are out-of-the-money, premiums are generally cheaper.

- Unlimited Upside: If the underlying rallies significantly, the call can deliver large gains.

- Downside Protection: If the underlying plunges, the put can become very profitable.

Potential Drawbacks

- Wider Breakeven Points: The underlying must move beyond both strikes enough to cover the combined premium cost.

- Time Decay: The longer the underlying stays near its current price, the more time decay erodes option premiums.

- Volatility Risk: If implied volatility drops after purchase, option premiums may decrease, hurting your positions.

Step-by-Step Implementation in Algomojo

Below is an example workflow for setting up a Long Strangle in Paper Trade mode. Adjust the strike selection and quantities based on your volatility outlook, risk tolerance, and market conditions.

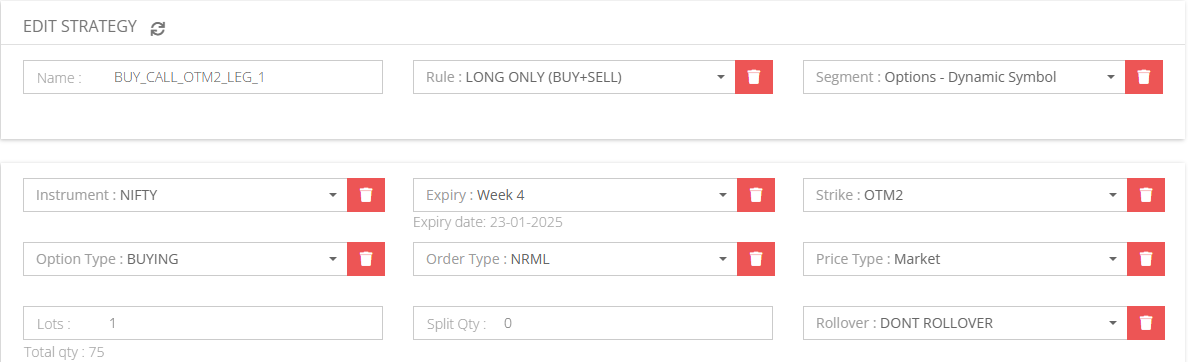

1. Create Buy OTM Call – Leg 1

- Path:

My Strategy => New Strategy - Configure a Buy Call option that’s out-of-the-money (strike above current market price).

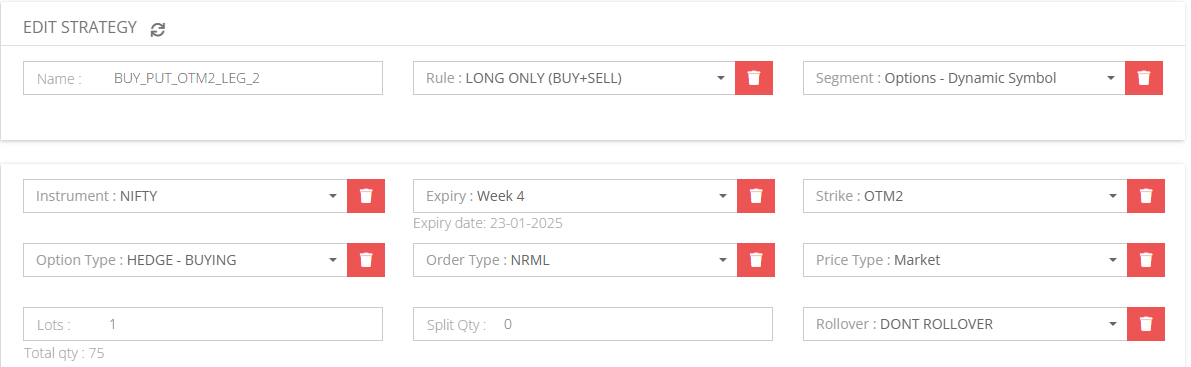

2. Create Buy OTM Put – Leg 2

- Path:

My Strategy => New Strategy - Configure a Buy Put option that’s out-of-the-money (strike below current market price), using the same expiration date as the call.

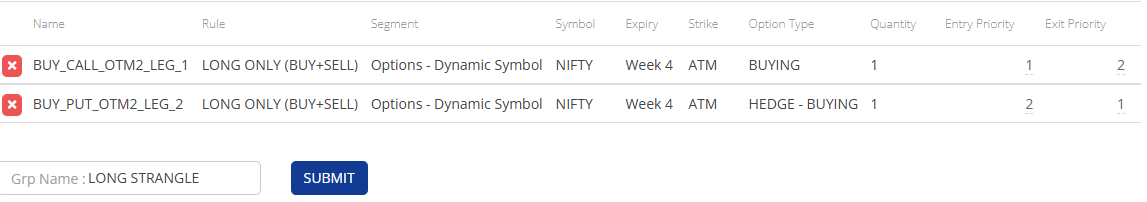

3. Create a Group Strategy

- Path:

My Group Strategy => New Group Strategy - Combine both legs (Buy OTM Call, Buy OTM Put) into a single group for synchronized execution.

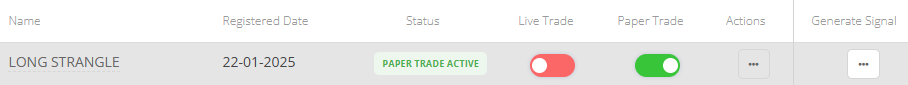

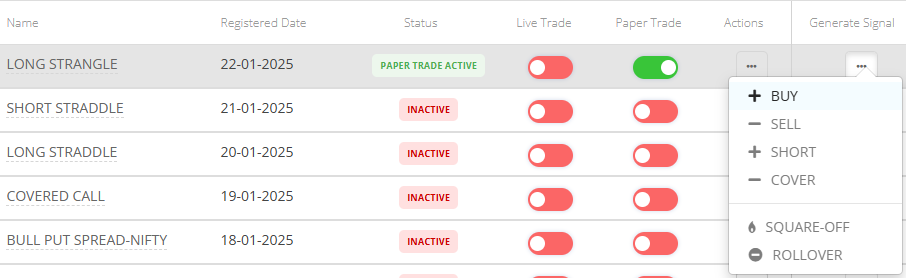

4. Switch on Paper Trade

- Path:

My Group Strategy - Enable Paper Trade mode to test your strategy risk-free before going live. This helps confirm your setup and execution flow.

5. Generate BUY Signal

- Path:

My Group Strategy - When your analysis suggests that a large price swing is imminent, trigger the BUY signal to open both OTM positions simultaneously.

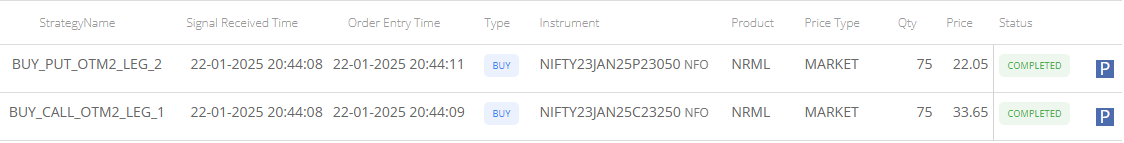

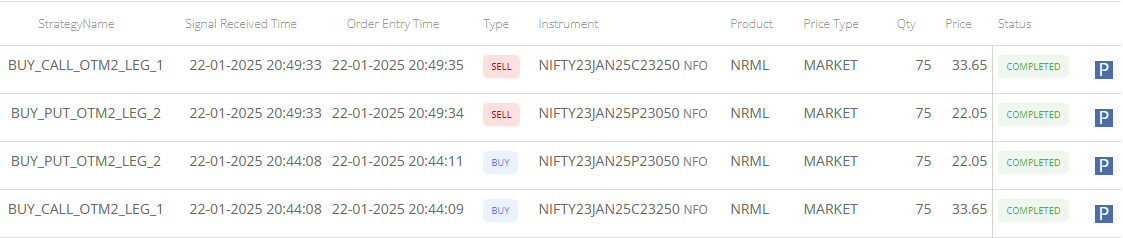

6. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Verify that both the call and put orders are placed at your specified strikes.

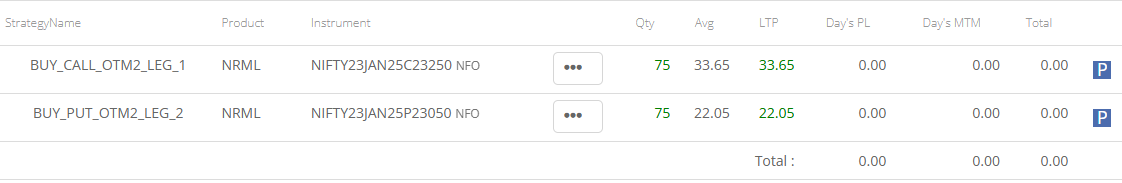

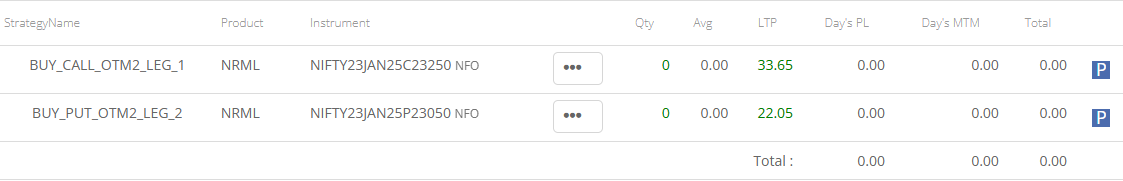

7. Positions after BUY Signal

- Path:

My Group Signals => Positions - Check your open positions to ensure you hold both legs of the strangle. Monitor the combined premium paid and keep track of the underlying’s price moves.

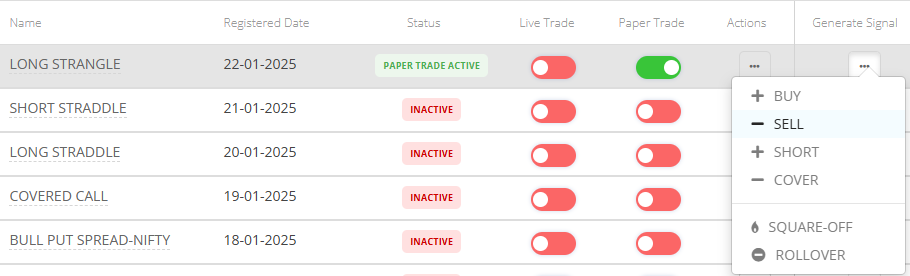

8. Generate SELL Signal (to Close)

- Path:

My Group Strategy - If you decide to exit (e.g., after a significant move or if time decay becomes a concern), trigger the SELL signal to close both legs.

9. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Confirm both OTM options are sold or otherwise closed as per your exit plan, locking in gains or limiting losses.

10. Positions after SELL Signal

- Path:

My Group Signals => Positions - Ensure you have no active positions. In a live market, you can track real-time MTM and Realised Day’s P&L within Algomojo.

Post-Trade Review

After the expiration or once you exit the strangle:

- Did the underlying move enough to surpass your combined premium cost?

- Were your timing and volatility assumptions correct?

- Could an alternate set of strikes or expiration have yielded better results?

Analyze these factors to refine future Long Strangle setups or other volatility-driven strategies.

Final Thoughts

A Long Strangle offers a lower-cost alternative to a Long Straddle for traders expecting significant volatility but unsure of direction. By routing your buy signals through Algomojo, you eliminate manual errors and focus on assessing market conditions, volatility, and proper risk management. Remember that Algomojo itself is only an execution platform—it doesn’t generate or guarantee profitable signals. Thorough backtesting, careful position sizing, and ongoing strategy refinement are key to finding success in options trading.

Happy Trading!