What is a Short Straddle?

A Short Straddle is an options strategy where you sell both a call option and a put option at the same strike price (often at-the-money) and the same expiration date. Unlike a Long Straddle, which aims to profit from large directional moves, a Short Straddle profits from low volatility and time decay—you expect the underlying’s price to stay near the strike, making both the call and put expire worthless.

Understanding the Short Straddle

How It Works

- Sell a Call Option at or near the current market price (ATM).

- Sell a Put Option at the same strike and expiration as the call.

By selling both options, you collect two premiums upfront, forming the maximum potential profit. However, if the underlying moves sharply in either direction, losses can be large (in theory, unlimited on the upside).

Key Benefits

- Immediate Premium Income: You collect premiums from both the call and put at initiation.

- Profit from Low Volatility: If the underlying price stays near your strike, both options can expire worthless, letting you keep the entire premium.

- Time Decay Advantage: As expiration approaches, if the underlying stays range-bound, time decay works in your favor.

Potential Drawbacks

- Unlimited Upside Risk: If the underlying surges well above the strike price, the short call can lead to significant losses.

- Substantial Downside Risk: A sharp drop below the strike also incurs losses on the short put.

- Requires Strong View on Volatility: You need to be confident the underlying won’t make big moves in either direction.

Step-by-Step Implementation in Algomojo

Below is an example workflow for setting up a Short Straddle in Paper Trade mode on Algomojo. Adjust strikes, quantities, and signals based on your market view and risk tolerance.

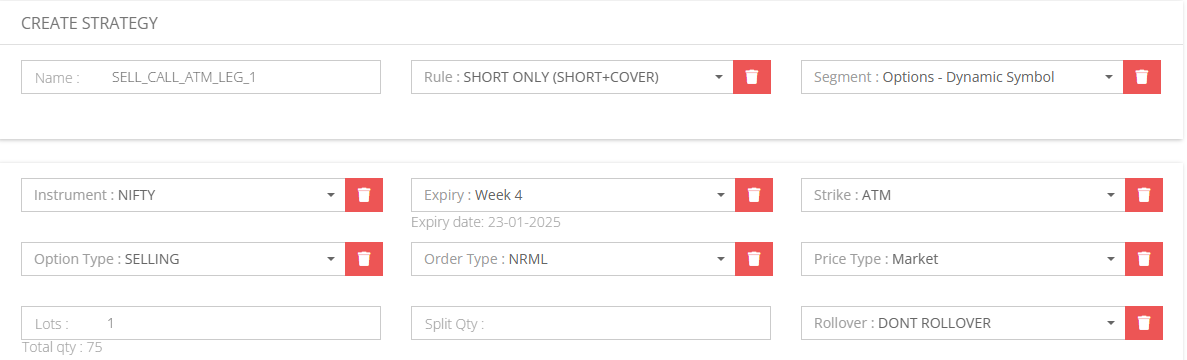

1. Create Sell ATM Call – Leg 1

- Path:

My Strategy => New Strategy - Configure a Sell Call order at or near the current market price (ATM).

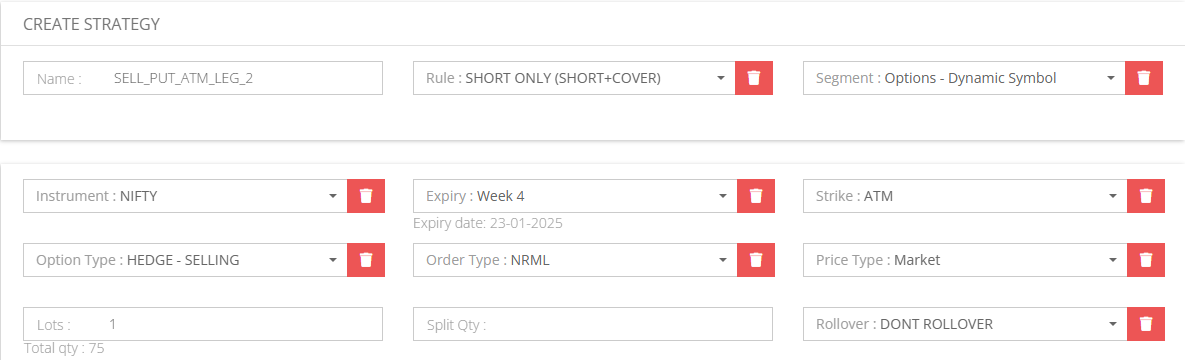

2. Create Sell ATM Put – Leg 2

- Path:

My Strategy => New Strategy - Configure a Sell Put order at the same strike and expiration as the short call.

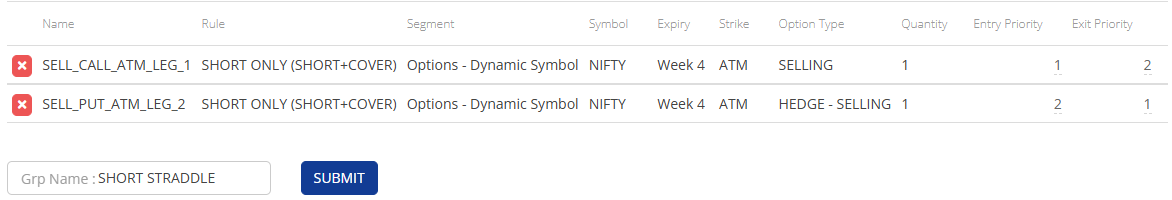

3. Create a Group Strategy

- Path:

My Group Strategy => New Group Strategy - Combine both legs (Sell ATM Call and Sell ATM Put) into one group for synchronized execution.

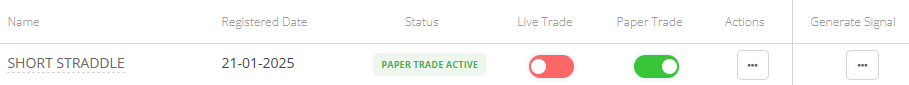

4. Switch on Paper Trade

- Path:

My Group Strategy - Toggle Paper Trade mode to test the setup risk-free, ensuring your signals and execution work as intended.

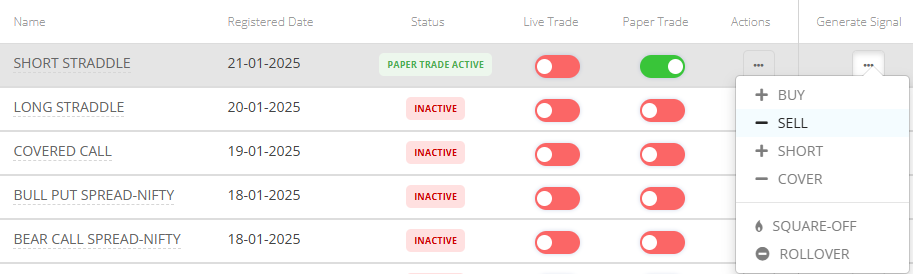

5. Generate SELL Signal

- Path:

My Group Strategy - When your analysis suggests the market will remain range-bound and volatility is low, trigger the SELL signal to open both short legs simultaneously.

6. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Verify that both the short call and short put were placed as expected.

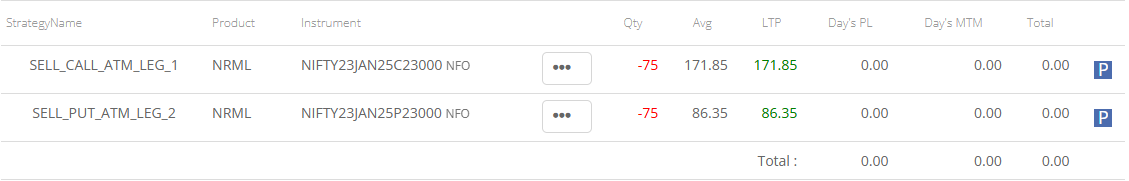

7. Positions after SELL Signal

- Path:

My Group Signals => Positions - Review your open positions to confirm you now hold a Short Straddle, and monitor premium received.

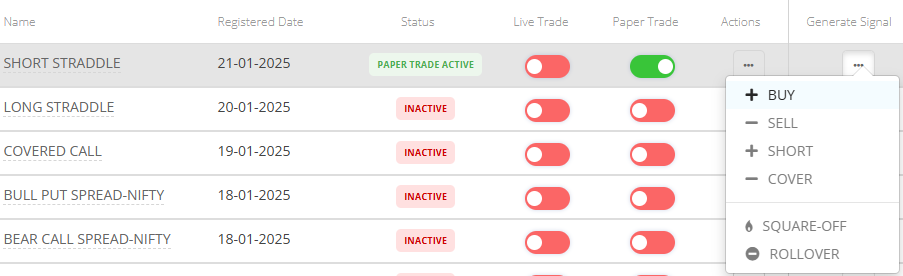

8. Generate BUY Signal (to Close)

- Path:

My Group Strategy - If you decide to close early—perhaps after collecting most of the premium or seeing signs of a big move—initiate a BUY signal.

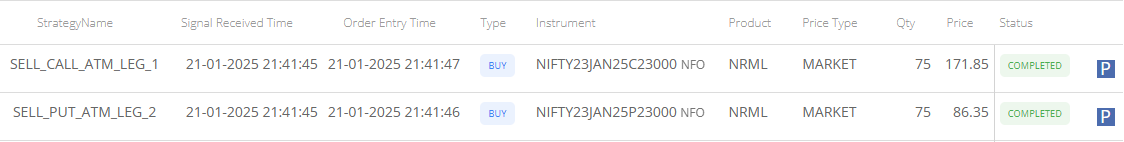

9. Executed Paper Trade Orders

- Path:

My Group Signals => Orders - Confirm both the short call and short put are closed. This finalizes your profit or loss.

10. Positions after BUY Signal

- Path:

My Group Signals => Positions - Ensure no open legs remain. During live market trading, you can track real-time MTM and Realised Day’s P&L in Algomojo.

Post-Trade Review

After the options expire or you exit your positions:

- Did the underlying remain near the strike, as anticipated?

- Were entry and exit signals timed effectively?

- Could you adjust strikes, expiration, or volatility assumptions for better outcomes?

Use these reflections to refine future Short Straddle attempts and other volatility-based strategies.

Final Thoughts

A Short Straddle can be highly profitable in low-volatility environments, but it carries significant risk if the market moves sharply in either direction. By routing your orders through Algomojo, you simplify the execution process, minimize manual errors, and focus on strategic considerations. Remember, Algomojo itself only executes your chosen strategies—it doesn’t generate or ensure profitable signals. Backtesting, risk management, and market awareness are critical to navigating the inherent risks of Short Straddles successfully.

Happy Trading!